Minimal Deposit:

Type of Trading:

- Scalping Strategy

Trading Pairs:

- 18 Pairs

Leverage:

- 1:200 or Higher

Terminal:

- MT4

Friendly EA Broker:

- XM Broker

THE MONEY TREE FOREX ROBOT

The Money Tree EA is one of the newest Forex robots produced and represented by the LeapFX company, which shows high results so far. In this review, we’re going to break down the live trading performance of this Forex robot. Read the following review to get additional information about The Money Tree EA.

The Money Tree Live Statistics with the Real Money Results

The developer of The Money Tree Robot provided us with one live trading performance account by the third-party company Myfxbook. The Money Tree Robot trades using an incredible number of 18 currency pairs such as AUDCAD, AUDCHF, AUDNZD, AUDUSD, EURAUD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY. The results of trading using all these currency pairs are available on the official Myfxbook account of the system. The Money Tree Robot has been trading live on the real account since the beginning of February 2022, which gives us only 4 months of long statistics.

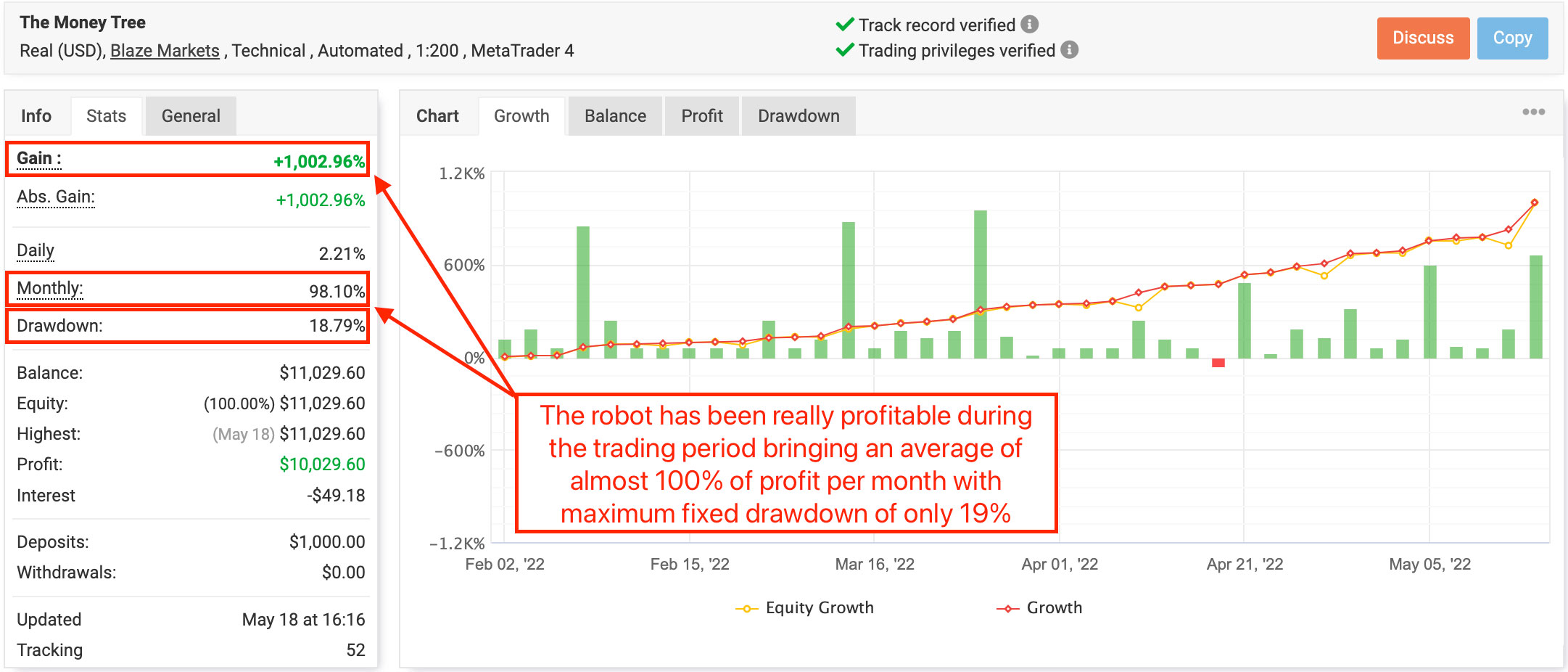

Considering the duration of the live trading accounts statistics, the results look pretty good. The Money Tree Robot reached an amount of 1002% of the profit on the live account. The statistics graphs of The Money Tree EA look clear and sows no downward movements, the main trend is upward, and the profit also confirms this.

There are no backtests made by the MT4 Strategy Tester for The Money Tree Robot, and no other kinds of backtesting are available on the official website of the robot.

THE MONEY TREE ROBOT – REAL

Profitability & Drawdown of The Money Tree EA

The Money Tree Robot is made to trade with a huge number of currency pairs – 18 currency pairs (AUDCAD, AUDCHF, AUDNZD, AUDUSD, EURAUD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY). It uses a 15M timeframe, and it is compatible only with the MT4 trading terminal. There is no recommendation given by the developer on the minimal leverage size for The Money Tree Robot but according to the official statistics of the EA, we can see that the developer chose to use 1:200 leverage which might be the recommended one.

The length of the live trading on the account with real money for The Money Tree Robot is only 4 months already as the live trading on the official Myfxbook account began on February 2, 2022. The robot has been able to get an outstanding amount of profit on the live trading account – 1002%. Still, there are no signs of some dangerous practices and technics that might have been done to boost the numbers.

As we can see from the screenshot above, having a really high cumulative gain, The Money Tree Robot also has got almost 19% of fixed drawdown level. At the same time, the monthly profit level of The Money Tree Robot is 98%. Considering those numbers, we can count an approximate ratio between profit and drawdown to see the real risk to reward correlation. Considering all the numbers, we can state the fact that The Money Tree Robot has got an approximate profit to drawdown ratio of 5:1 which is an incredibly high number.

The Money Tree Robot Type of Trading

There are some clues given by the developer of The Money Tree Robot to understand the trading logic and algorithms included and programmed into the EA. Usually, LeapFX gives almost no information about the inner logic of their robots, but it seems to be changing, which is a good signal. Foremost, the developer declares that The Money Tree Robot does not use a grid and hedging in its trading. There are no statements about Martingale’s strategy, so it probably might be used. We’ll try to see if it is true by analyzing the trading graphs of the EA. Anyway, there is more information about the system given by the developer.

First of all, it is declared that The Money tree EA uses Dynamic Trailing System or DTS (Dynamic Trailing Stop) which is usually used as a “Smart Stop” technology that identifies consolidation and pinpoints support and resistance levels. Basically, it is used to protect gains while minimizing risk. In addition, the robot also uses a combination of custom volatility filters and custom moving average filters. There is no detailed information about the exact filters and indicators used in the live trading of The Money Tree Robot but still, there is some touch of understanding of the potential technologies used in the robot.

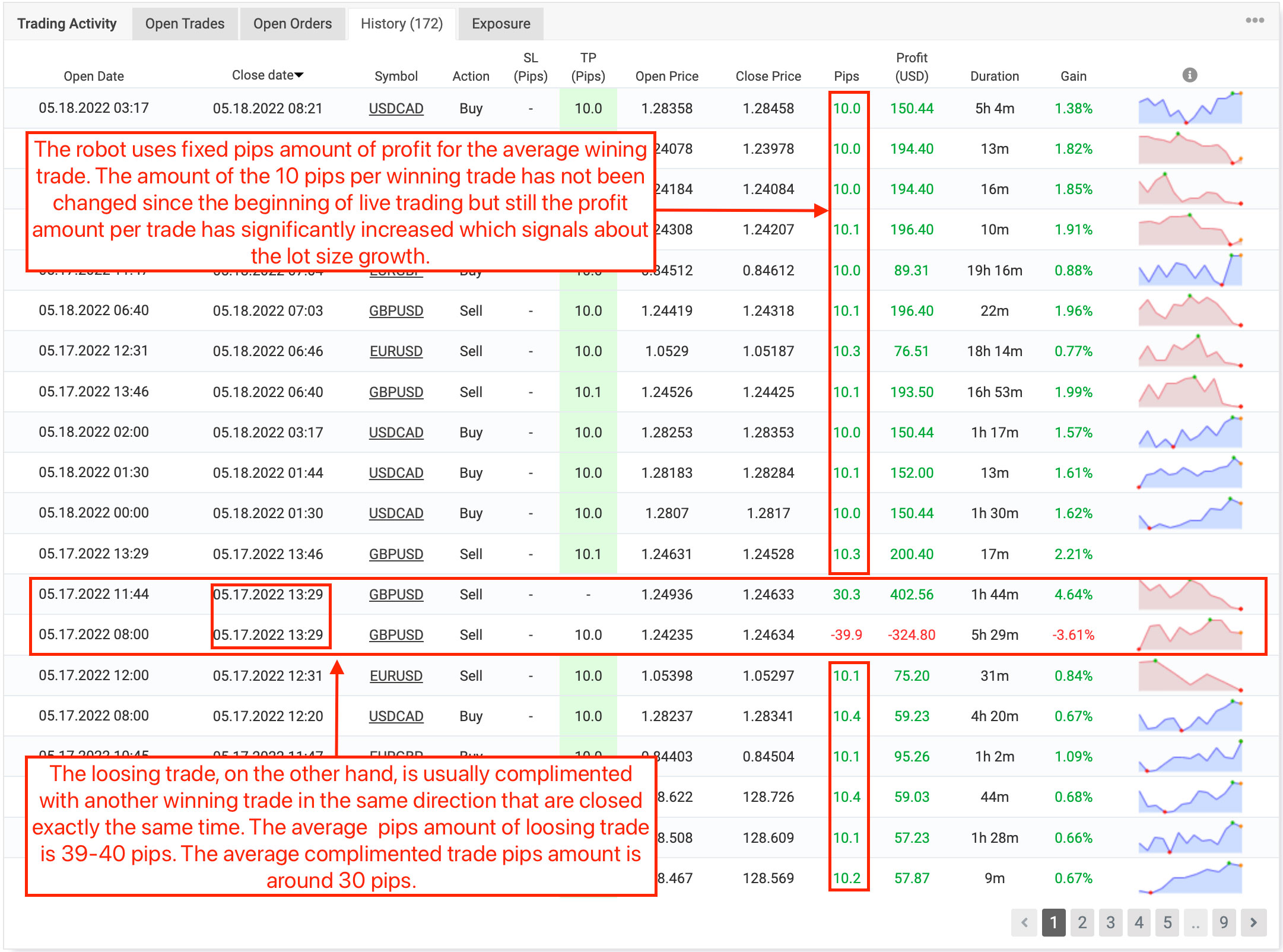

Moving on, we come to the trading statistics analysis. And to begin with, let’s mention that the developer hid the lot size numbers from the live trading charts, so it will complicate the analysis a little. Anyway, the first thing we can see about the live trading of The Money Tree Robot is that the system uses a fixed number of pips taken by the average winning trade. The amount of 10 pips is pre-programmed for the system as a take profit level. It has not been changed since the beginning of live trading, but the profit amount per winning trade has increased significantly, which signals the lot size growth through time. This leads us to the conclusion that The Money Tree Robot uses the compound interest to grow the account (look at the screenshot below).

The losing trades, on the other hand, usually have a 39-40 pips stop-loss limit and every losing trade goes along with the complimented winning trade. The winning trades are opened in the same direction as the losing ones, so it excludes the possibility of the hedging usage, as it is declared by the developer. The pips amount of the average complimented winning trade is around 30 pips. Usually, the profit amount of those winning trades is higher than the amount of money lost. This also means that those complemented trades usually have a slightly higher lot size than the losing ones (look at the screenshot above).

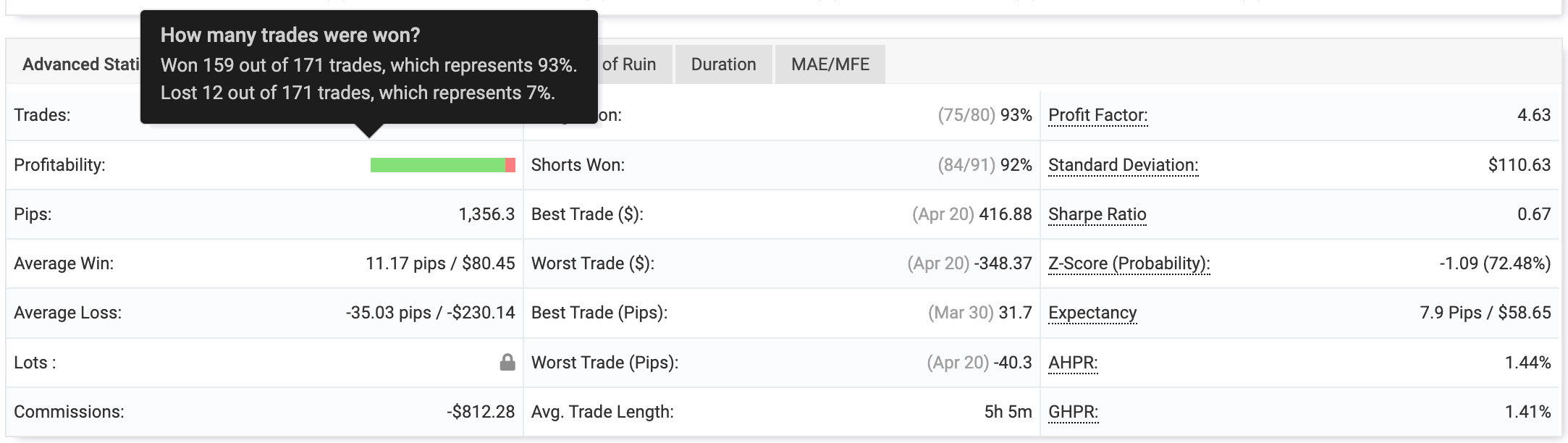

The Money Tree Robot has a really high percentage ratio between won and lost trades – 93/7%. It is an incredibly high number for any Forex robot. Also, as we can see from the screenshot below, the system trades pretty often. The Money Tree EA has done 171 trades during its 4 months trading history. It means that the system on average makes 42 trades per month or 1.4 trades per day, which is what the developer claims about the robot – The Money Tree Robot trades every day.

As it is clearly seen from the following screenshot, The Money Tree EA usually closes trades in a range from 10 minutes to 5 hours. Still, some orders are closed during a short period such as 2-3 minutes, but it does not look like a systematic thing. Also, the system closes most of the trades during the period up to 1 day.

Conclusion

The Money Tree Robot is a newly released Forex EA that shows an incredible profit to drawdown ratio and tends to trade in a way to bring high profit with low risks. The system manages to keep the account growing fast with high monthly profitability and also has almost no fixed deep drawdowns during its 4 months trading history. There is also some hidden information about this robot that might have changed the way I look at The Money Tree EA, but now I can say that the system deserves your attention.