Minimal Deposit:

Type of Trading:

- Grid/Trend Strategy

Trading Pairs:

- USDCAD, EURUSD

Leverage:

- 1:200 or Higher

Terminal:

- MT4, MT5

Friendly EA Broker:

- XM Broker

FX MULTICORE

Introducing the FX MultiCore EA, a sophisticated 100% automated Forex robot engineered for consistent profit-making with a keen focus on safeguarding your capital. Functioning round-the-clock, the FX MultiCore EA operates on two major currency pairs, USDCAD and EURUSD, through its dual-core system. Read on the further FX MultiCore review to know more about this newest Forex robot.

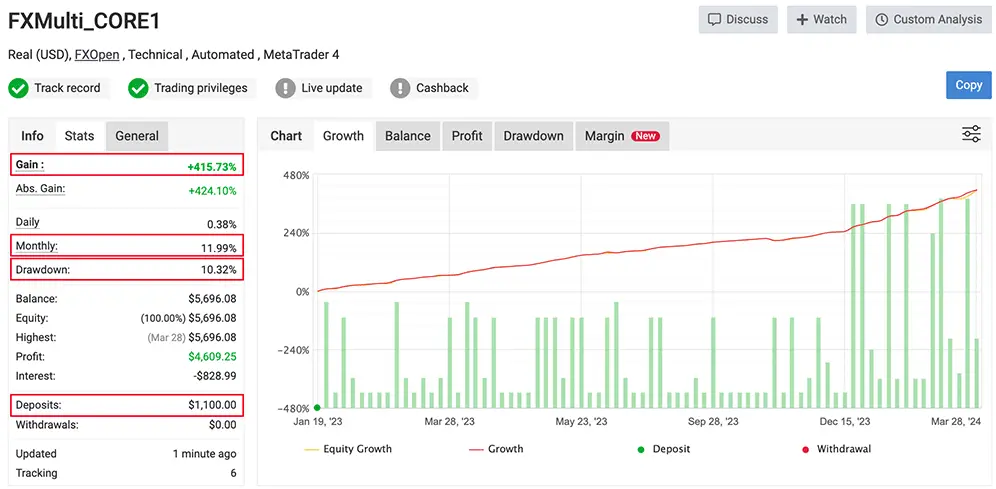

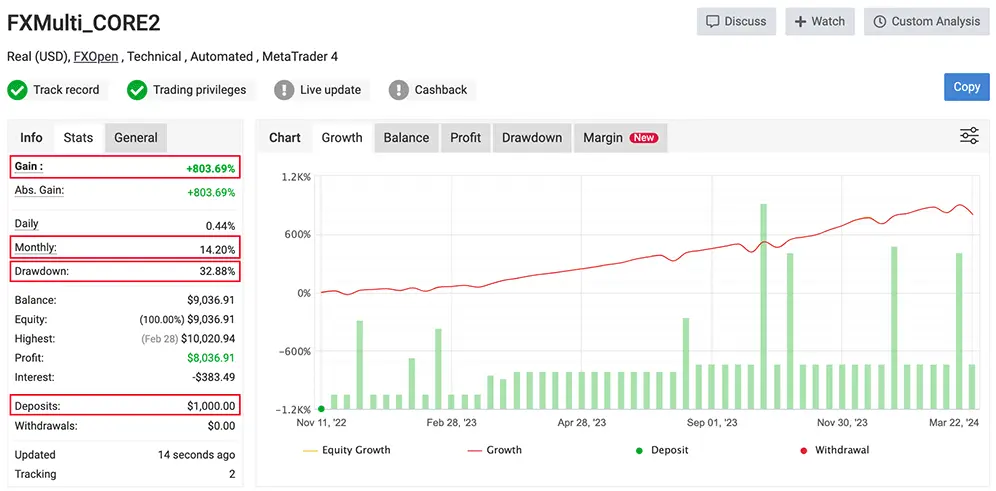

FX MultiCore EA Live Statistics with the Real Money Results

The FX MultiCore EA, an advanced Forex trading robot, has showcased notable results via its two real live trading accounts known as CORE1 and CORE2. These accounts are publicly verified on the Myfxbook platform and have been actively trading the USDCAD and EURUSD pairs for periods of 15 and 17 months, respectively.

FX MultiCore EA began its live trading journey with the FXMulti_CORE2 (EURUSD) account in November 2022, starting with an initial investment of $1000. It then expanded its operations to the FXMulti_CORE1 (USDCAD) account in January 2023, with a starting deposit of $1100. Demonstrating exceptional profitability, the robot has achieved substantial gains of +803.69% over 17 months and +415.73% over 15 months respectively. These figures highlight the robot’s impressive trading performance.

FXMultiCore EA – CORE1 (USDCAD) Real

FXMultiCore EA – CORE2 (EURUSD) Real

The trading charts for both accounts display a consistent and strong upward trajectory, with minimal instances of sharp declines or drawdowns. This steady progress is remarkable, as it differs from the typical fluctuations seen with swift growth in trading accounts. The sustained success of FX MultiCore EA highlights the effectiveness of its trading strategies and risk management protocols.

The EA’s trading results reflect a thoughtful and calculated trading style, prioritizing the reduction of risks while pursuing profit maximization. The FX MultiCore Forex robot demonstrates its proficiency in managing the complexity of the Forex market through a calculated and methodical approach, marking its significance in the automated trading sector.

Profitability & Drawdown

CORE1 Profitability to Drawdown Review

Live trading of the FXMulti_CORE2 account began in January 2023 with an initial fund of $1100. The FX MultiCore EA’s live trading record on the FXMulti_CORE1 account reveals a significant profit surge of +415.73% over a 15-month period, with the highest recorded drawdown at only 10.32%.

A closer look at the EA’s real live performance on this account allows us to measure its future potential and the balance between profits and drawdowns. The essential trading metrics for the FX MultiCore EA CORE1 account are as follows:

Trading duration: 15 months

Cumulative Profit: 415.73%

Highest fixed drawdown: 10.32%

These figures suggest a Profit-to-Drawdown ratio of approximately 2.5:1 for the FX MultiCore EA’s CORE1 account, indicating that for every unit of drawdown, the EA generates about 2.5 units of profit. This ratio demonstrates the EA’s profit-generating efficiency and its dependability as a Forex trading robot.

It’s important to note that these results are based on actual trading with real funds on a live Myfxbook account, not merely simulations or backtests. This fact lends additional weight to the FX MultiCore EA’s performance, proving its ability to produce real results under live market conditions.

While these outcomes are impressive, it’s essential to remember that past performance is not indicative of future results. Nonetheless, these achievements place the FX MultiCore EA among the top contenders in the ForexStore rankings, making it a standout choice for traders aiming to optimize profitability with managed risk levels.

CORE2 Profitability to Drawdown Review

FX MultiCore EA began its live trading on the FXMulti_CORE2 account in November 2022 with an initial fund of $1000. The performance to date has been great, having a profit increase of +803.69%, which supports the developer’s statements about the algorithm’s effectiveness and efficiency.

The EA’s performance has been consistently positive, with an average monthly growth of 14.20%, contributing to its strong and enduring performance. These results highlight the EA’s potential for solid returns and affirm the strength of its trading strategy. The maximum recorded floating drawdown of the system was recorded at the level of 32.88%, which might reflect the possible high-risk settings chosen for the account.

By examining the FX MultiCore EA’s actual performance on a live account, we can conclude its prospects and the ratio between its profits and drawdowns. Here are the key trading metrics for the FX MultiCore EA highlighted in this review:

Trading duration: 17 months

Cumulative Profit: 803.69%

Highest average drawdown: 32.88%

With these metrics, the Profit-to-Drawdown ratio for the FX MultiCore EA’s CORE2 account stands at approximately 1.5:1. This indicates that for every unit of drawdown experienced, the EA generates around 1.5 units of profit. This favorable ratio attests to the FX MultiCore EA’s profitability and reliability as a Forex trading robot.

Type of Trading

CORE1 Trading Analysis

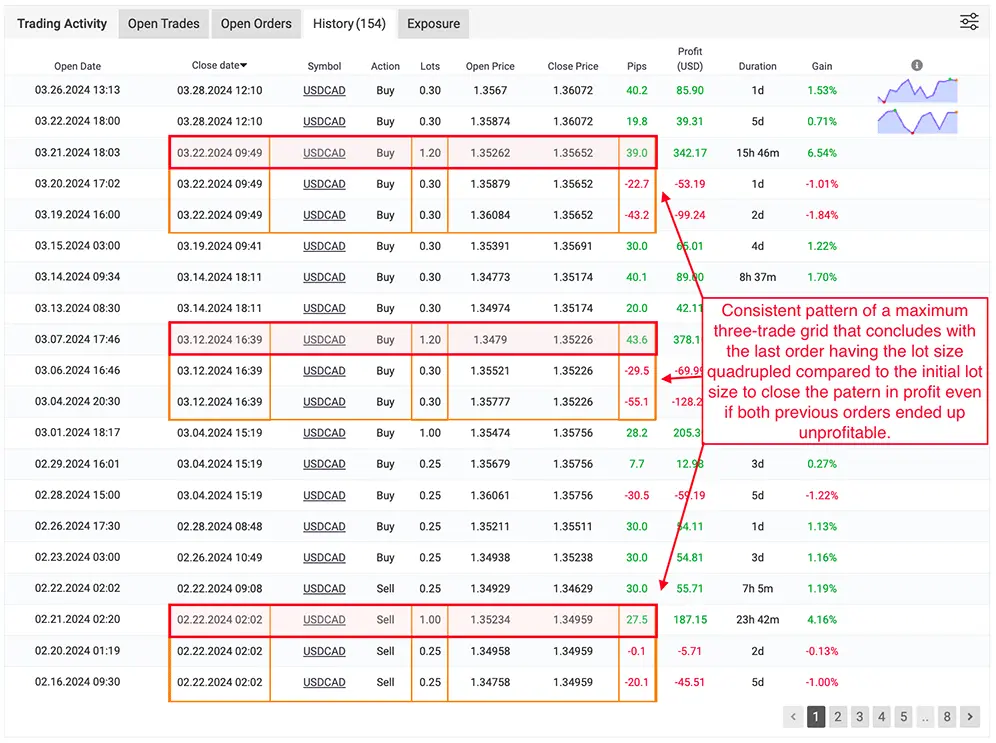

The analysis of the FX MultiCore EA’s live trading data on the CORE1 account reveals the application of a specialized grid trading method. According to the developer, the EA is designed to manage up to three simultaneous orders. The trading pattern is clearly visible: the EA selects an entry point and, if the initial trade doesn’t yield profit, the system initiates an additional order. If the first two trades are not profitable or bring almost no profit, a third trade is launched with a lot size that is 4 times larger than the initial one, aiming to cover the previous losses and secure a profit. All trades of one grid are always executed in the same direction, either as Buy or Sell orders.

This allows us to say that the system uses multiplied lot size in cases of previous losing trades, which helps the system to close the whole grid in profit even when having not-profitable trades. This lot size increment looks a little bit like some kind of modified Martingale strategy but with specifically pre-set and fixed lot size increments (the initial lot size is always multiplied by 4 for the third order in the grid).

Interestingly, the system does not use lot-size multiplication for the second trade after the first winning trade. This indicates that the Martingale pattern is used solely for the recovery process after a losing trade. By refraining from multiplying the lot size for winning trades, the system reduces the potential risk of incurring larger losses in the event of a prolonged losing streak.

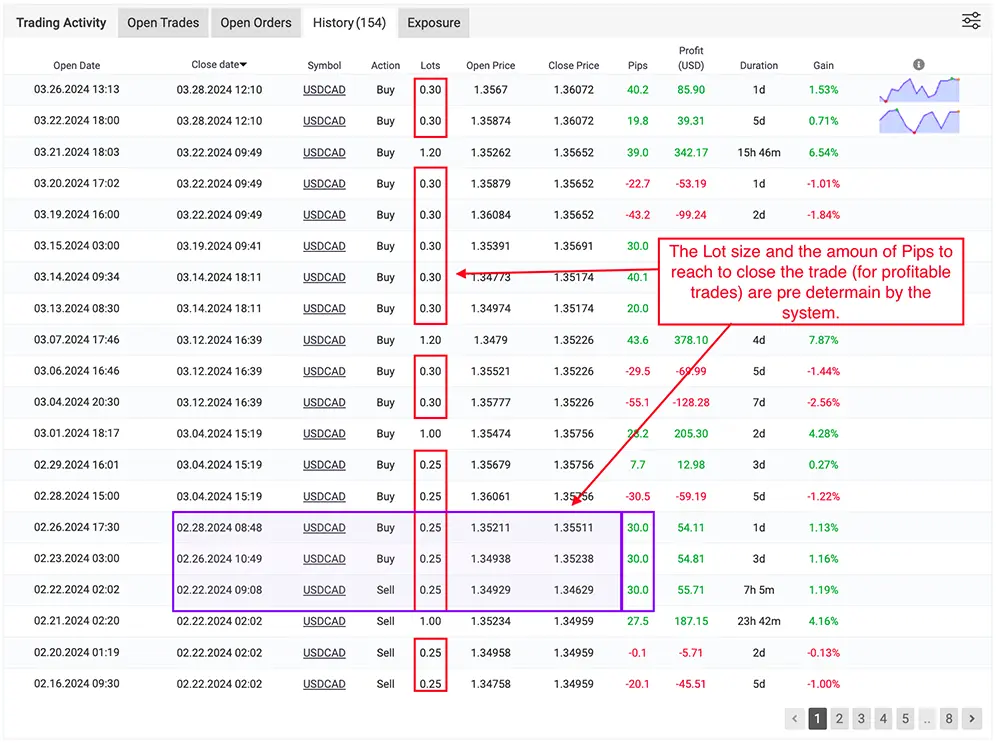

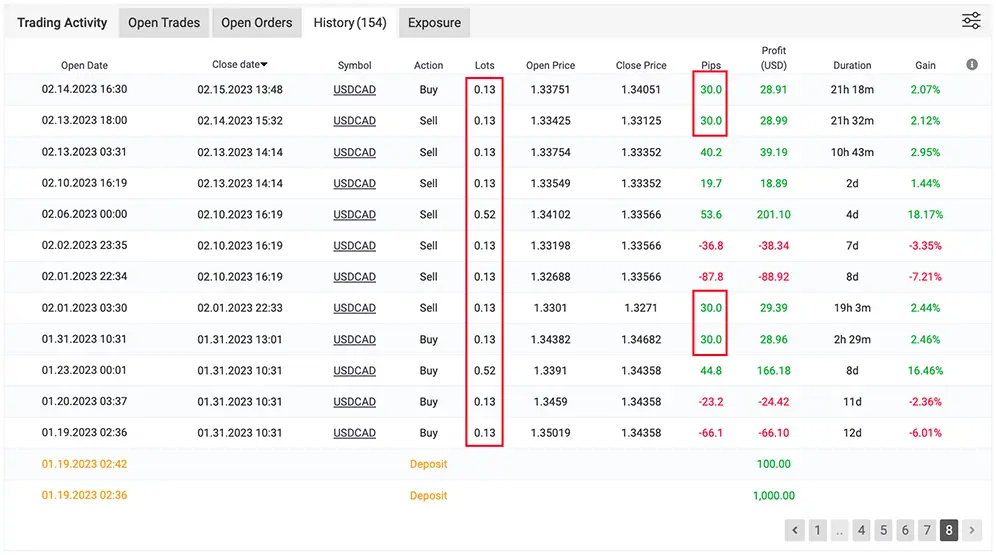

As shown in the following picture, the initial lot size is pre-set by the system and at the moment is 0.30 Lot. The same is true for the amount of profitable trades (30.0 at the moment). In the example below we can see the three separate profitable trades (marked with purple) closed out of any grids with the same amount of pips set as TakeProfit for each.

Also, the FX MultiCore EA employs a compound interest strategy in determining its default lot size, as evident in the following screenshot. The initial lot size, starting at 0.13 during the beginning of live trading, has progressed to 0.30 as of the current review. This method facilitates a step-by-step expansion of the lot size, enabling the system to manage more substantial trades as it acquires additional market expertise and experience.

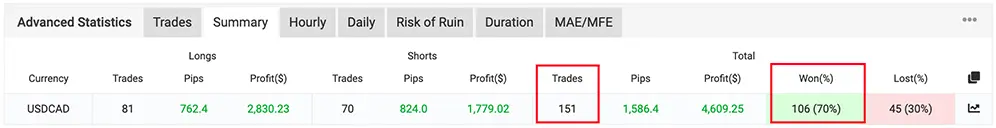

In the span of 15 months, the FX MultiCore EA has completed 151 trades, showcasing its robustness and reliability. On average, this amounts to about 5 trades per month. The system’s performance is commendable, with a win-loss ratio of 70% to 30%, indicating that successful trades more than double the unsuccessful ones, confirming the EA’s proficiency in profit generation.

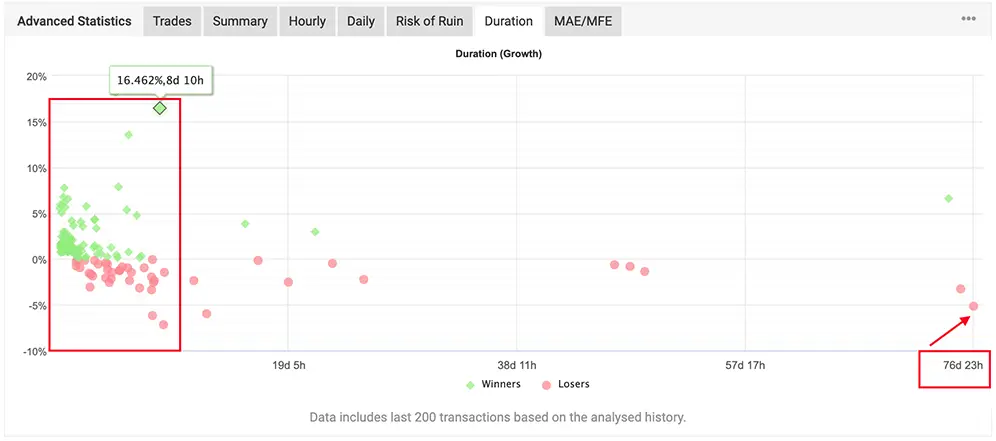

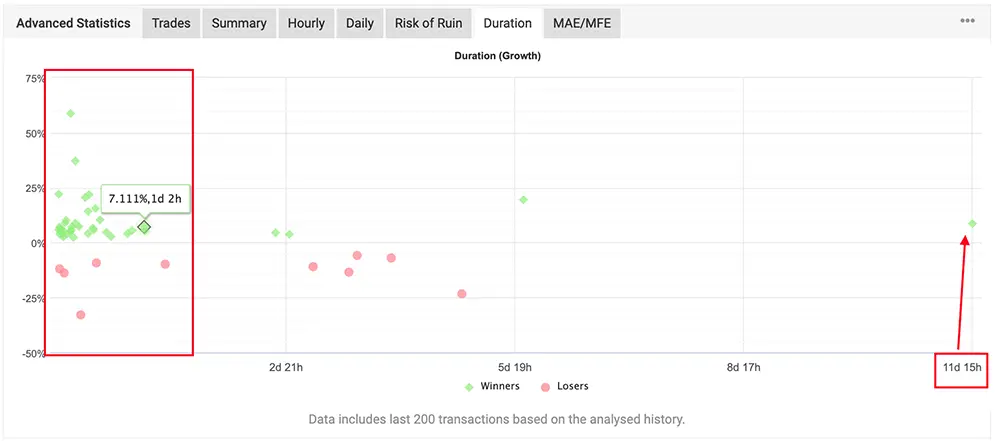

The duration of the FX MultiCore EA’s trades on the market varies widely, from as little as 20 minutes to as long as 76 days. Typically, trades last between 1-2 hours to 7-8 days, demonstrating the system’s ability to seize short- to medium-term market opportunities.

It’s interesting to note that the most profitable trades for the FX MultiCore EA occur within a timeframe of 11 minutes to 7 days. Analysis of the trading data shows that trades left open for extended periods tend to result in losses.

CORE2 Trading Analysis

By looking at the trading graphs CORE2 account it becomes obvious that the claims of the developer about “two completely different systems in one” are true indeed. The CORE2 system seems to work completely differently from what we saw in the operation of the CORE1.

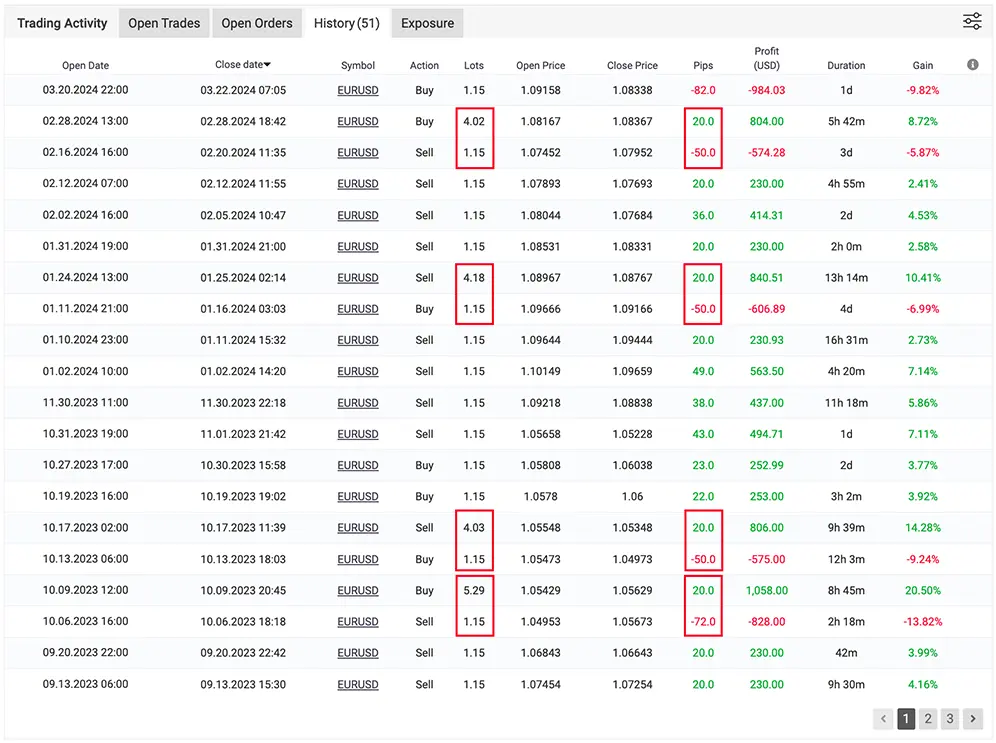

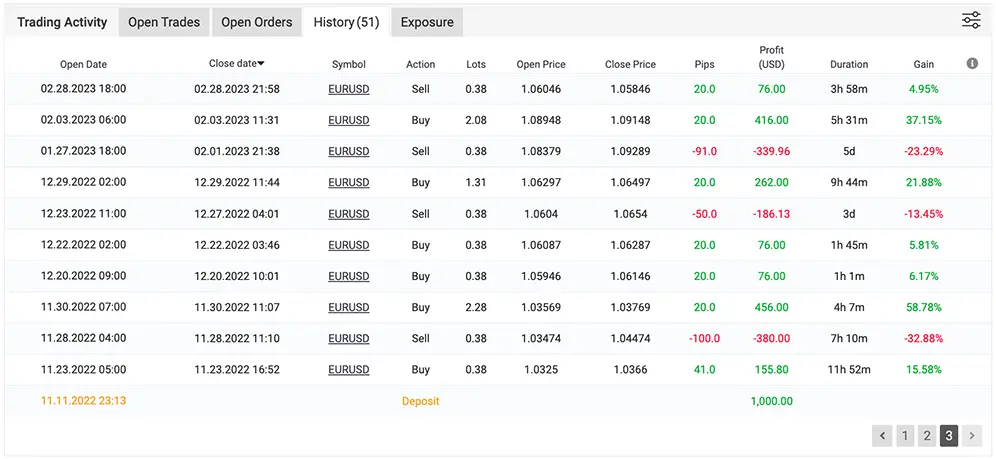

We could identify only a few insights about the systems’ trading patterns from the trading graphs. The first and most important one is that the robot does not use the Grid strategy and does not allow trades to be opened simultaneously. However, the system uses lot size multiplication for recovery purposes, as is evident from the screenshot below.

As we can see, there is a clear pattern of every unprofitable trade to be followed by the trade with multiplied lot size which always has a pre-determined amount of pips (always 20 pips in the case of this account). However, the lot size can be increased dramatically (up to 4-5 times higher than the initial one). The actual multiplier seems to depend on the amount of money lost during previous unprofitable trade and not on the amount of pips lost.

The FX MultiCore EA utilizes a compound interest approach for the CORE2 account as well as for CORE1 (as seen in the screenshot below). This is demonstrated by the growth of the initial lot size from 0.38 at the start of live trading to 1.15 at the time of this review. This gradual increase in lot size allows the system to handle larger trades progressively, reflecting its growing proficiency and market experience.

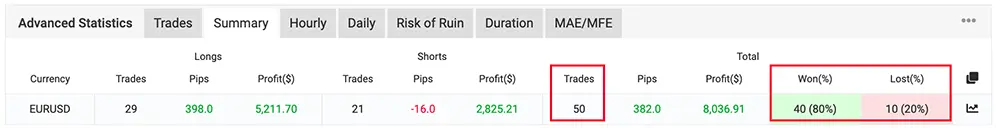

In 17 months, there have been 50 trades completed on the CORE2 account. On average, this is equal to around 3 trades per month. The system’s performance has been amazing in terms of a win-loss ratio. It stands on the level of 80% to 20%, indicating that successful trades more than double the unsuccessful ones, confirming the EA’s proficiency in profit generation.

The duration of the FX MultiCore EA’s trades on the market varies from 40 minutes to as long as 11 days. Typically, trades last between 40 minutes to 1 day.

Conclusion

In conclusion, the FX MultiCore EA stands out as a robust and reliable automated trading system, demonstrating impressive gains of +803.69% and +415.73% on its CORE2 and CORE1 accounts respectively over a considerable period. Its strategic use of a modified grid trading approach, coupled with a compound interest strategy, allows for consistent profitability and effective risk management. The system’s ability to maintain a favorable win-loss ratio and its adaptability to varying trade durations further attest to its efficacy. With real money trading results that reinforce its performance claims, the FX MultiCore EA emerges as a compelling choice for traders seeking a sophisticated and dependable Forex trading robot.