Minimal Deposit:

Type of Trading:

- Grid Strategy

Trading Pairs:

- EURUSD, USDCAD, GBPUSD, EURJPY and AUDUSD

Leverage:

- 1:500 or Higher

Terminal:

- MT4, MT5

Friendly EA Broker:

- XM Broker

FX QUAKE

Meet review for FX Quake EA review, the ultimate 100% automated Forex robot designed for relentless profit generation while prioritizing the safety of your investments. Operating 24/7 across five major currency pairs, including EURUSD and GBPUSD, FX Quake employs a unique algorithm for strategic entry points and subsequent order calculations, ensuring a continuous stream of profits without prolonged unprofitable periods.

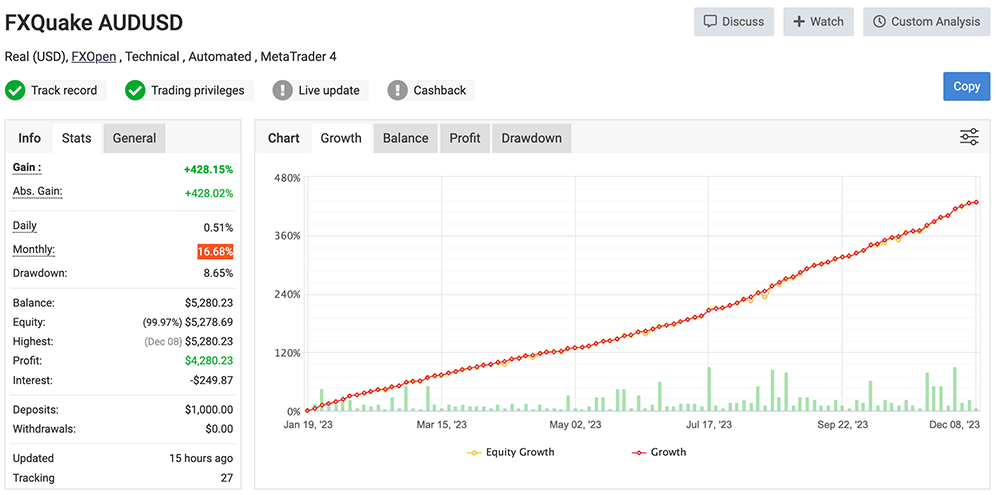

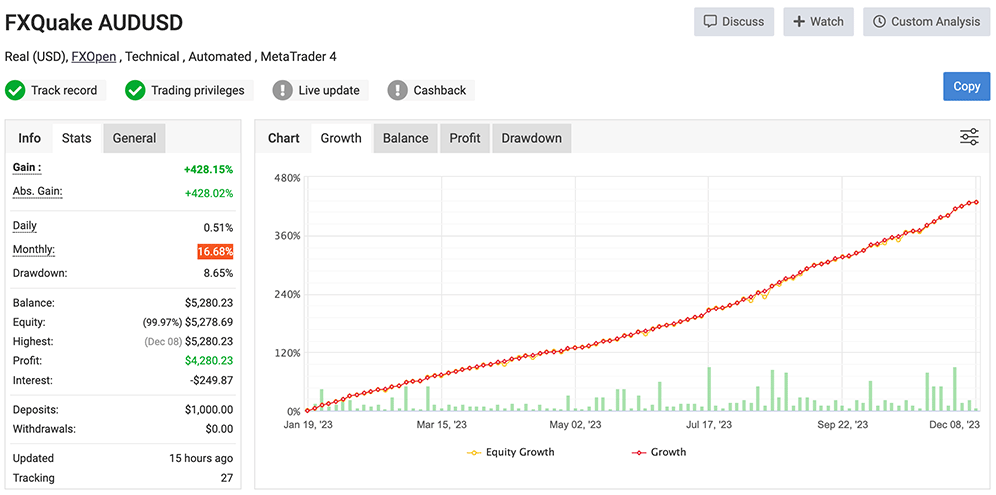

FX Quake EA Live Statistics with the Real Money Results

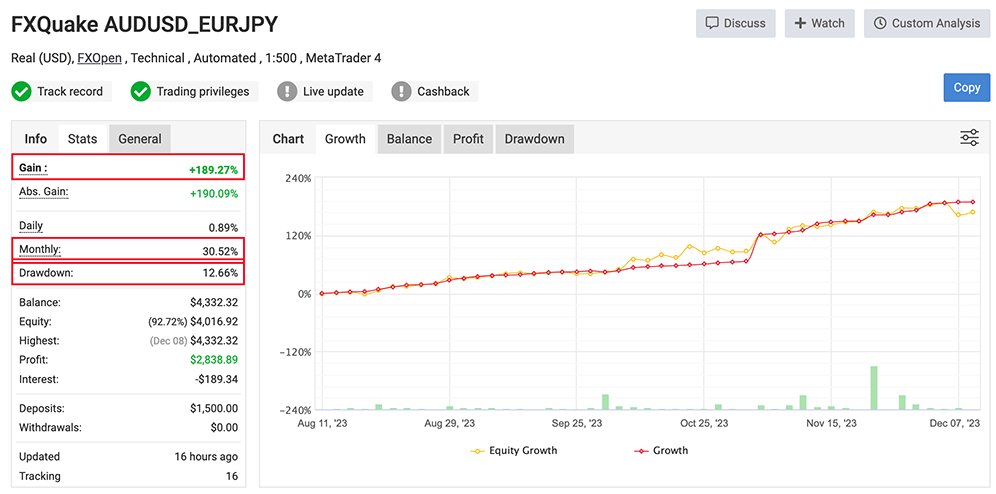

The FX Quake EA, a sophisticated Forex robot, has demonstrated impressive performance through its two real live trading accounts hosted on the Myfxbook third-party platform. These accounts have been diligently operating within the AUDUSD and EURJPY currency pairs for durations of 12 and 4 months, respectively.

Initiating live trading in January 2023 with an initial deposit of $1000 for the AUDUSD account, and subsequently commencing trading on the EURJPY account in August 2023 with an initial deposit of $1500, FX Quake EA has showcased remarkable profitability. Over the 12-month and 4-month trading periods, the robot has yielded impressive profits of +428.15% and +189.27%, respectively.

FXQuake EA – AUDUSD Real

FXQuake EA – AUDUSD and EURJPY Real

The live graphs depicting the trading curves for both accounts reveal a robust upward trend, characterized by a notable absence of sharp edges or drawdowns. This stability is particularly noteworthy, as it defines the volatility commonly associated with rapid account growth. FX Quake EA’s capacity to deliver sustained profitability underscores the efficacy of its underlying trading strategy and risk management system.

The EA’s performance exemplifies a moderate and balanced approach to trading, emphasizing a commitment to minimizing losses while maximizing profits. The FX Quake Forex robot stands as a testament to its ability to navigate the complexities of the Forex market with a level-headed and strategic approach, establishing itself as a noteworthy player in the realm of automated trading.

Profitability & Drawdown

The live statistical overview of the FX Quake EA started in January 2023, featuring an initial deposit of $1000 on the “FX Quake AUDUSD” account. The subsequent performance analysis reveals a remarkable gain of +428.15% since the start, justifying the developer’s claims regarding the efficacy and productivity of this trading algorithm. Noteworthy is the consistent upward trajectory, with an average monthly growth rate of 16.68%, adding to the sustained and robust performance of the FX Quake EA. Such evident outcomes underscore the potential for solid returns and confirm the credibility of the EA’s trading approach.

Looking at the “FX Quake AUDUSD” Myfxbook account, it’s remarkable to observe that the FX Quake EA has significantly grown by an impressive 428.15% since it commenced trading. This indicates the Forex robot’s effectiveness in generating substantial returns. Notably, the system’s best monthly return is 16.68%, showcasing its ability to achieve solid monthly growth. Additionally, the highest drop in account value, known as the floating drawdown, is limited to 8.65%, signifying a controlled risk approach.

These metrics collectively underscore the FX Quake EA’s potential to yield profits in the dynamic and often unpredictable Forex market. Considering its consistent growth and prudent risk management, the FX Quake EA is positioned as a compelling choice for traders seeking an automated solution.

Looking at the actual performance of the FX Quake EA on real live accounts, we can make some predictions about how well this trading robot might do in the future. In the span of a year, the FX Quake EA has gained an impressive 428.15%. Additionally, the highest average drop in account value, known as the fixed drawdown, is 8.65%. When we look at the relationship or ratio between profit and drawdown, it’s almost 4:1. This means for every unit of drawdown, there are about four units of profit. These results strongly suggest that the FX Quake EA is not only profitable but also dependable as a Forex robot.

Reviewing the live performance of the FX Quake EA on the “FX Quake AUDUSD_EURJPY” real live account, we observe an 189.27% profit gain over four months. In addition, the highest fixed drawdown for the system is recorded at 30.52%. Assessing the relationship between profit and drawdown, the ratio is approximately 1.6:1. This signifies that for every unit of drawdown, there are about 1.6 units of profit.

It’s crucial to highlight that these outcomes are reached with real money from trading on a live Myfxbook account, not just from simulations or backtesting. This adds credibility to the FX Quake EA’s performance, showing it can deliver tangible results in real market conditions.

However, it is important to bear in mind that past performance does not guarantee future results. While these results may not claim the top spot among trading robots on ForexStore, they undeniably stand out and establish the FX Quake EA as an option for traders seeking to maximize profitability while minimizing risks.

Type of Trading

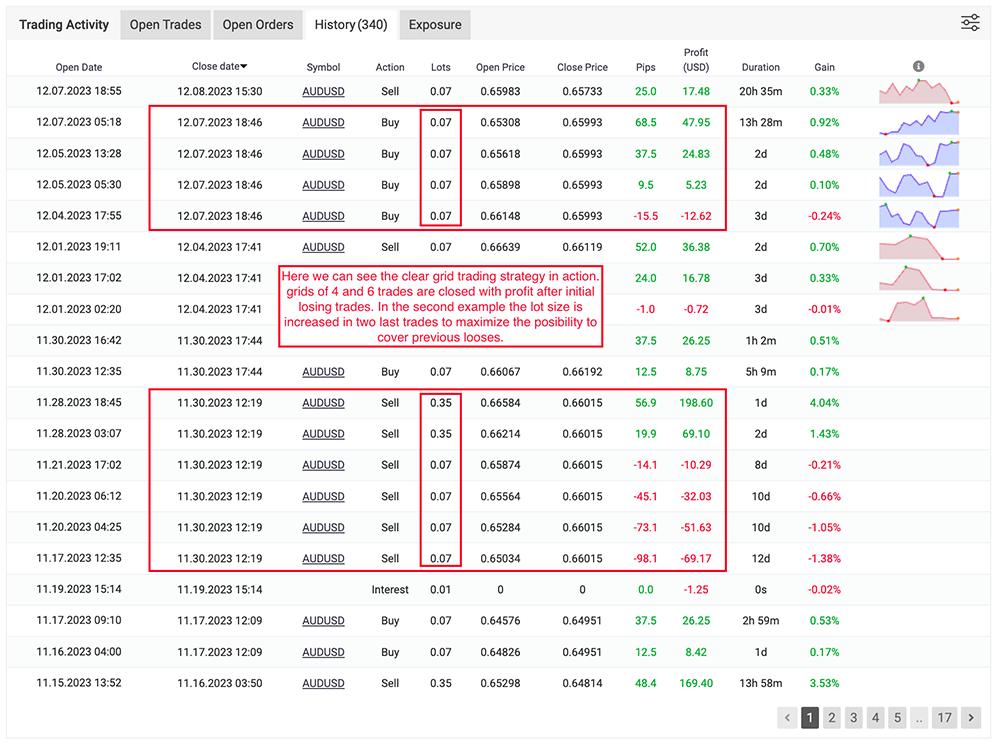

Further analysis of the live performance of the FX Quake EA is based on the live Myfxbook standings from the AUDUSD account, which is the longest-performing live account of the system so far.

Upon analyzing the live performance graphs of the FX Quake EA, it is evident that the system utilizes a grid trading strategy, as the developer mentioned it. Also, the system uses some kind of multiplied lot size in cases of previous losing trades, which helps the system to close the whole grid in profit even having some not-profitable trades in it. This lot size increment looks a little bit like some kind of modified Martingale strategy but with specifically preset and fixed lot size increments (from 0.07 to 0.35 lot in this case). It is also worth noting that the FX Quake robot does not always use multiplied lot size to close an initially unprofitable grid in profit. This is probably because, after the first order, all subsequent orders of the system (if they are necessary) have their own calculations, where and what kind of order should be opened, relative to the first one.

In the previous picture, we can see the clear grid trading strategy in action. grids of 4 and 6 trades are closed with profit after initial losing trades. In the second example, the lot size is increased in the two last trades to 0.35 lot to maximize the possibility of covering previous losses.

Interestingly, the system does not use lot-size multiplication for the grids of winning trades. This indicates that the Martingale pattern is used solely for the recovery process after a losing trade. By refraining from multiplying the lot size for winning trades, the system reduces the potential risk of incurring larger losses in the event of a prolonged losing streak.

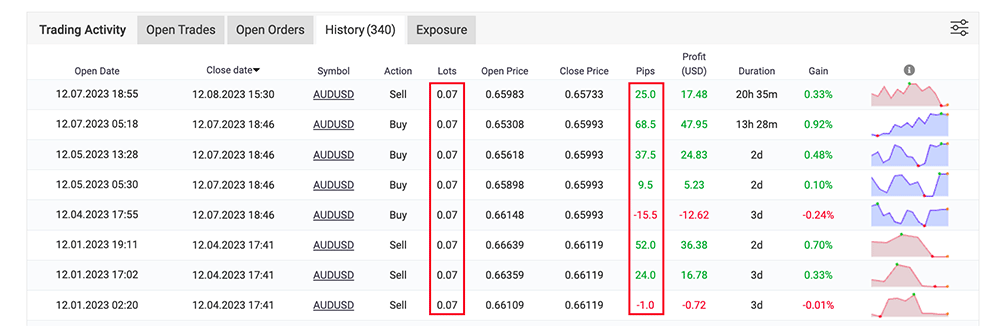

As shown in the following picture, the initial lot size for the AUDUSD currency pair is 0.07. However, the pips taken in each trade vary, depending on the market conditions at the time of execution. This approach ensures that the system is adaptable to the ever-changing market conditions and can execute trades efficiently.

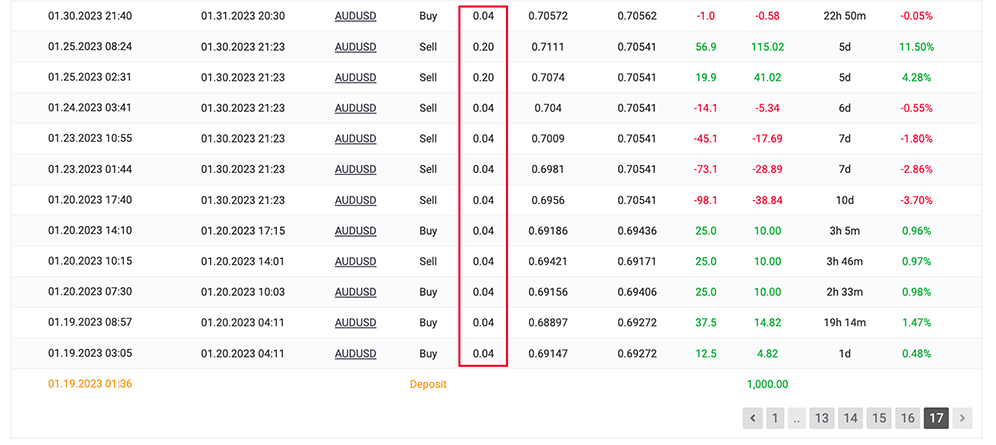

Also, the FX Quake EA employs a compound interest strategy in determining its default lot size, as evident in the following screenshot. The initial lot size, starting at 0.04 during the commencement of live trading, has progressed to 0.07 as of the current review. This method facilitates a step-by-step expansion of the lot size, enabling the system to manage more substantial trades as it acquires additional market expertise and experience.

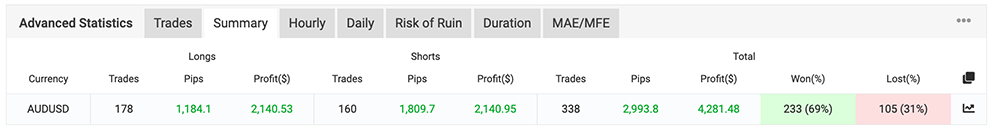

Over the past year, the FX Quake EA has executed a total of 338 trades, underscoring its resilience and dependability. This equates to an average of around 28 trades each month, nearly reaching a daily trading frequency, emphasizing the EA’s proactive trading approach. Furthermore, the system’s noteworthy performance is evident, boasting a commendable win-loss ratio of 69% to 31%. This signifies that the FX Quake EA achieves over double the number of successful trades compared to unsuccessful ones, affirming its effectiveness in generating profits for users.

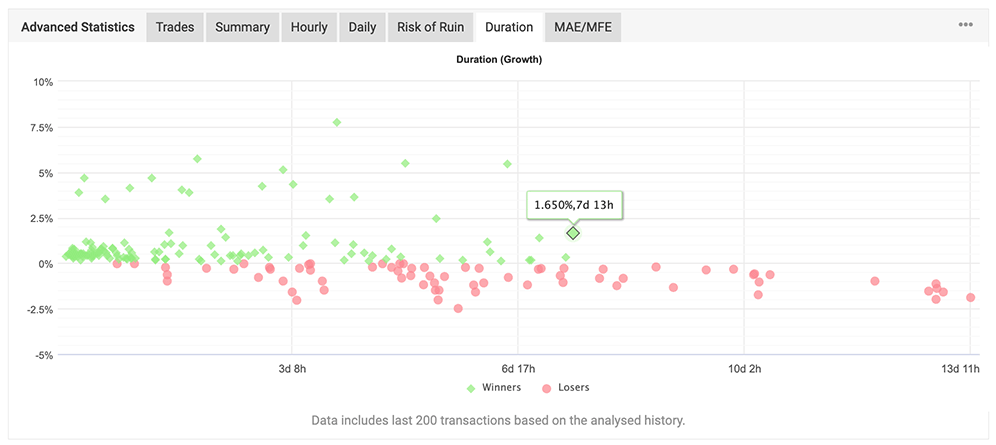

The FX Quake EA’s trades may remain open on the market for a duration ranging from 11 minutes to 10-13 days. However, the approximate average duration of trades is from 1-2 hours to 7-9 days, indicating the system’s proficiency in capturing opportunities within short to medium timeframes.

Interestingly, trades’ duration ranges from 11 minutes to 7 days is where the FX Quake EA tends to make the most profitable trades. As demonstrated by the graphs in the following screenshot, most of the trades that remain open in the market for longer periods eventually become losing ones.

The ability of the FX Quake EA to optimize its trade durations according to market conditions enhances its potential to generate profits for traders. By analyzing market trends and acting in advance, the system maximizes its chances of closing trades at optimal levels, thus minimizing losses and maximizing profits.

Conclusion

In summary, the FX Quake EA, a sophisticated Forex robot, has delivered impressive live trading results over 12 and 4 months in AUDUSD and EURJPY pairs. With initial deposits of $1000 and $1500, respectively, the robot achieved profits of +428.15% and +189.27%. Noteworthy is its stable upward trend, showcasing a strategic approach that defies common volatility. The FX Quake EA’s active trading nature, averaging almost one trade per day, and a win-loss ratio of 69% to 31%, highlight its proficiency. Real live account statistics reveal a 4:1 ratio between profit and drawdown, emphasizing its profitability and reliability. The robot’s grid trading strategy, strategic order management, and drawdown limiting system contribute to its adaptability across diverse market conditions, making it a compelling choice for traders seeking consistent profits with controlled risk.