Minimal Deposit:

Type of Trading:

- Grid Strategy

Trading Pairs:

- EURUSD, USDCHF

Leverage:

- 1:200 or Higher

Friendly EA Broker:

- XM Broker

FXGOODWAY EA is an automated trading system that’s been on a market for a long time and today we`re going to review the newest version of this Forex robot that’s been released not long ago. So, dive deeper into this FXGOODWAY EA review to see all the pros and cons of this robot.

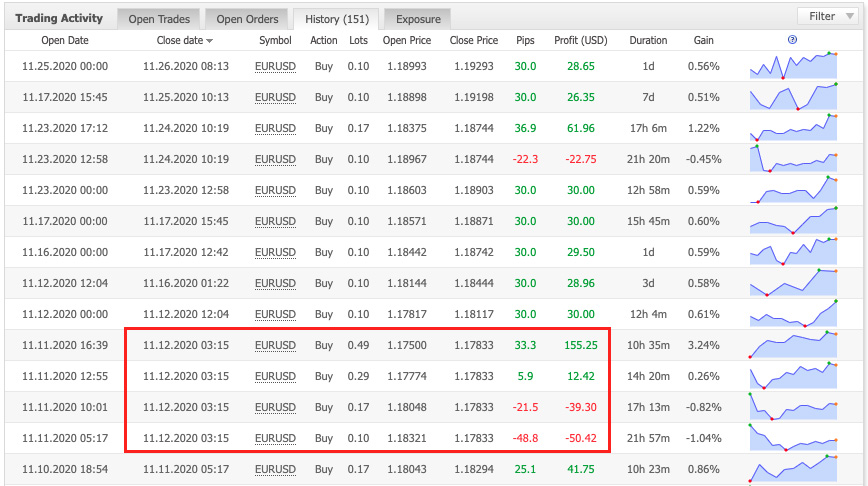

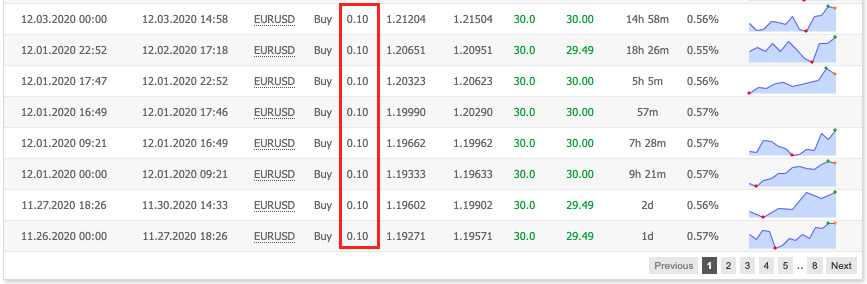

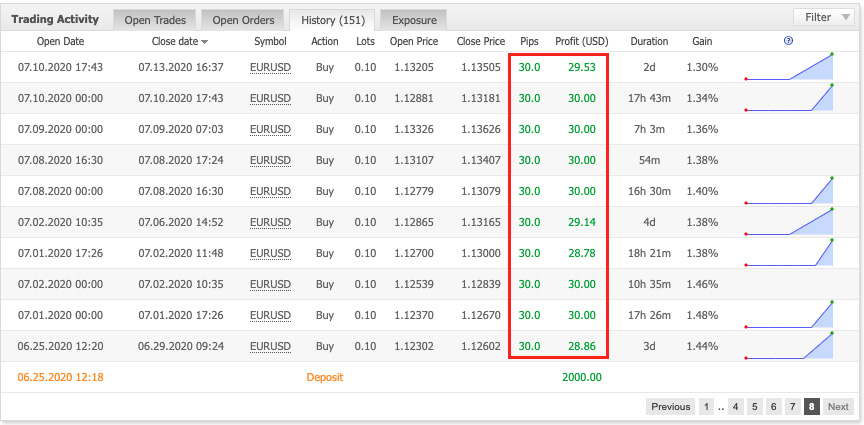

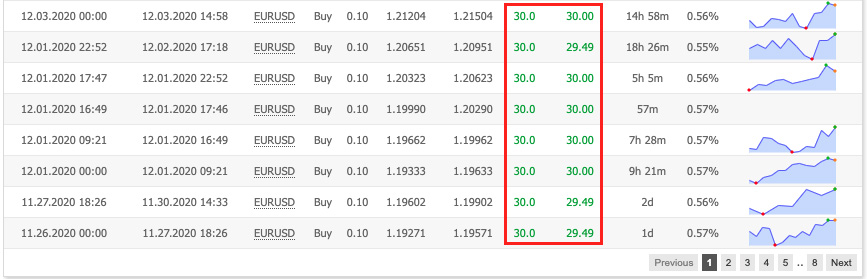

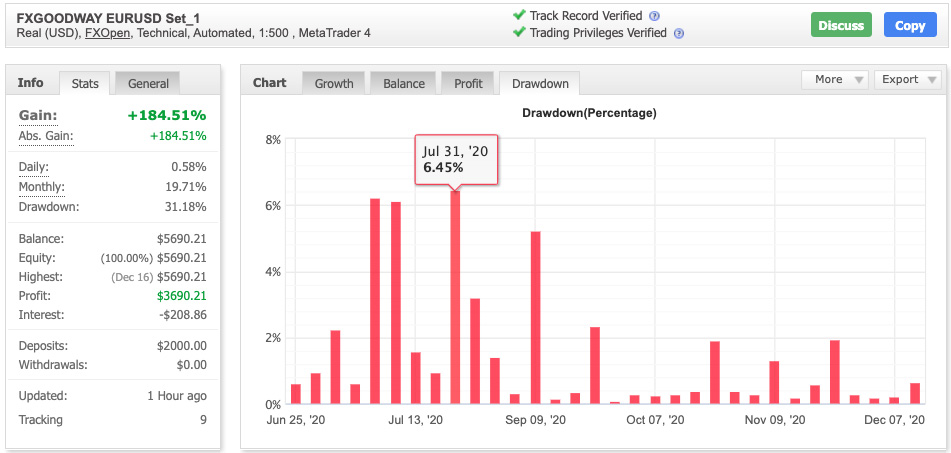

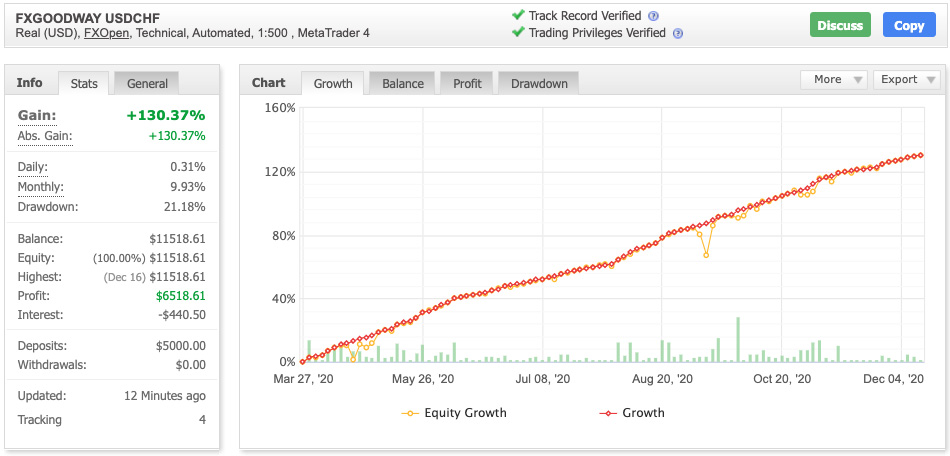

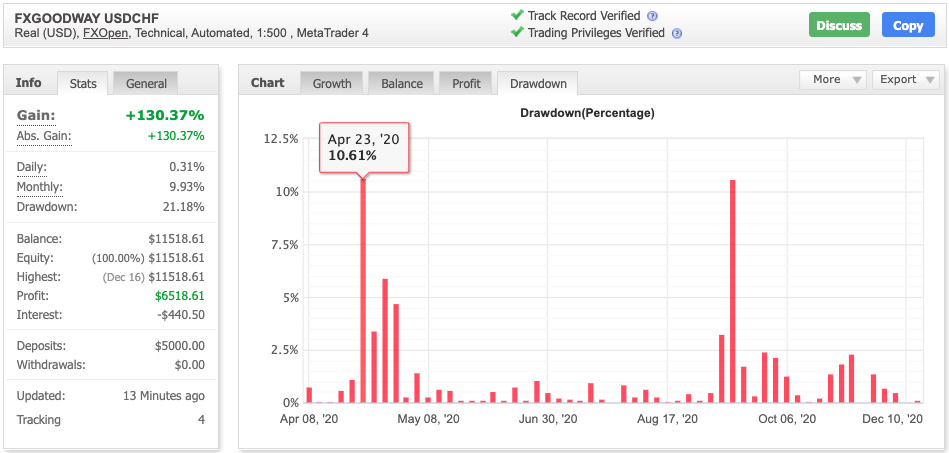

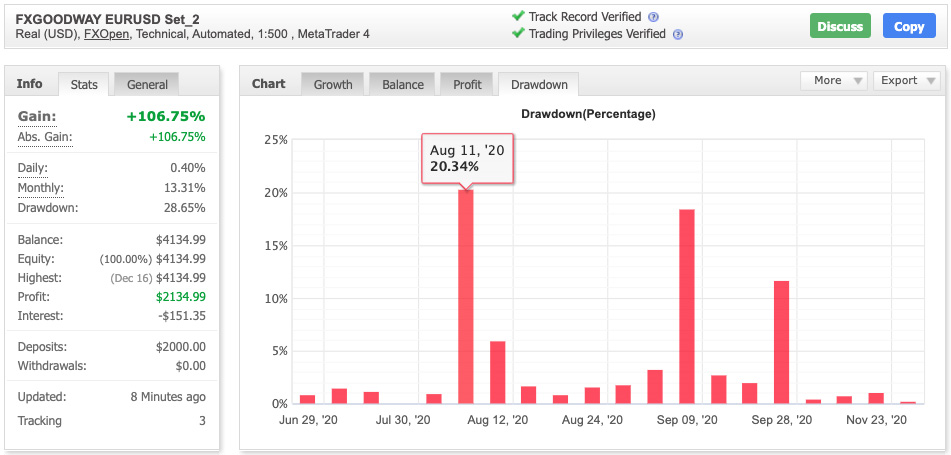

Live Statistics with the Real Money Results

There are three live trading accounts of FXGOODWAY EA available on Myfxbook. Two different sets of EURUSD currency pair and an account of the USDCHF currency pair. The two accounts of the EURUSD pair were set up on June 25, 2020, while the USDCHF account begun trading on March 27, 2020. This gives us 7 and 10 months of live trading to analyze respectively. As we can see all of the statistics of the robot show strong upward movement with no stop-losses which speaks up about the reliable nature of the robot. Nevertheless, there are a few long drawdowns on EURUSD set 2 and USDCHF accounts that however never were closed in a loss.

EURUSD Set_1 – Real

USDCHF EURUSD Set_2 – Real

Backtest Statistics

There is also one backtest per each live Myfxbook account of FXGOODWAY EA available. All three backtests were made on the historical quotes from 2015 to 2020 which is 5 years of backtesting. All the backtests were also made on the basic MetaTrader backtester on the 1H timeframe with 90% accuracy which is okay for this EA because it does not use scalping strategy and doesn’t need the precise every tick data for its proper work. As we can see from the statistics the EA showed itself very stable and constant.

FXGoodWay EURUSD Set_1

FXGoodWay EURUSD Set_2

FXGoodWay USDCHF

Profitability & Drawdown

Type of Trading