Minimal Deposit:

Type of Trading:

- Grid Trading Strategy

Trading Pairs:

- AUDUSD, EURJPY, EURGBP, USDCAD, EURUSD

Leverage:

- 1:100 or Higher

Terminal:

- MT4, MT5

Friendly EA Broker:

- XM Broker

FX JETBOT EA

In this review, we will focus on analyzing the FX JetBot EA – one of the newest Forex robots that have already shown itself as a very profitable trading system. In this Forex robot review, we’re going to break down the pros and cons of this EA to see if it’s worth purchasing for long-term trading.

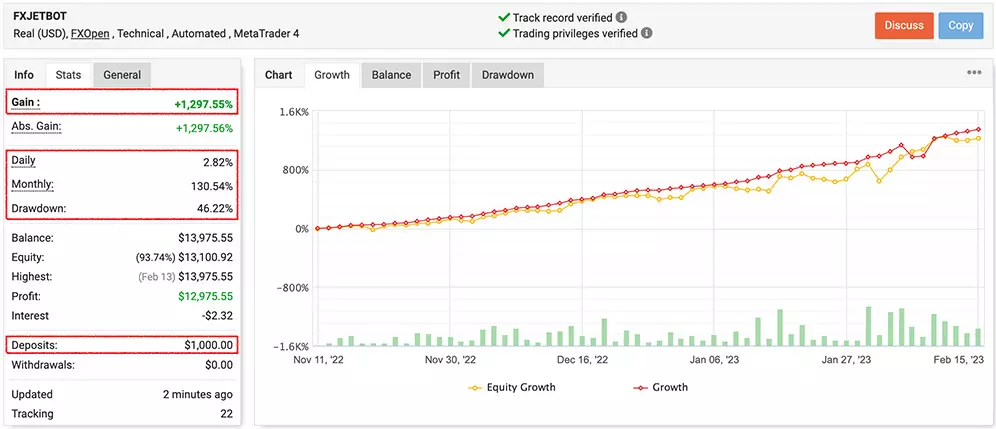

FX Jet Bot EA Live Statistics with the Real Money Results

There is only one live trading account of FX JetBot EA on the Myfxbook third-party company that provides objective live trading performance statistics. The trading account was set up in November 2022 with an initial deposit of $1000 and has already been working live successfully for almost five months. There are 5 currency pairs that the robot is currently configured and works best with. And this live account of the developer of FX JetBot EA works on all five suggested by the developer currency pairs: AUDUSD, EURJPY, EURGBP, USDCAD, and EURUSD.

FX JetBot EA has been successfully collecting profit since the day it started trading live and at the moment of writing this review the gain on the account is +1,297.55%. The trading curve of live graphs for this automated Forex trading system has a strong upward trend and has almost no sharp edges or drawdowns, as it could be appearing due to fast account growth.

FX JetBot – Real 1

FX JetBot USDCAD – Real 2

FX JetBot EURGBP – Real 3

Fx JetBot EA Backtest Statistics

AUDUSD Aggressive

EURJPY Aggressive

EURGBP Aggressive

USDCAD Aggressive

EURUSD Aggressive

AUDUSD Normal

EURJPY Normal

EURGBP Normal

USDCAD Normal

EURUSD Normal

FX JetBot EA is a well-backtested system as the developer of the robot presented to the potential clients a long list of backtests which consists of 10 positions. Developers of this Forex robot made sure that every currency pair the robot is able to trade on is backtested properly. Each of the 5 currency pairs that are supported by the FX JetBot EA is backtested using “Aggressive” settings and “Normal” settings on the historical quotes from 2018 to 2023.

All the backtests were made on the basic MetaTrader backtester on the 1H timeframe with 90% accuracy which is okay for this EA because it does not use a scalping strategy and doesn’t need the precise every tick data for its proper work. As we can see from the statistics the results were better than expected. This Forex system showed high profitability and good stability on all 5 currency pairs.

Profitability & Drawdown

FX JetBot EA is the multi-currency automated Forex trading system that has been released with the ability to conduct live Forex trading with real money using 5 currency pairs: AUDUSD, EURJPY, EURGBP, USDCAD, and EURUSD. The live training of the FX JetBot robot started on November 11, 2022, with the initial account deposit of $1000 and it has already been successfully trading live with real money for 4 months.

Minimum deposits for every currency pair the FX JetBot EA trades with are: EURUSD – $105, USDCAD – $105, AUDUSD – $145, EURGBP – $145, EURJPY – $190, for 0.01 lot. You should have at least $190 to be able to trade on all the supported currency pairs together.

Having a short period of only 4 months of live trading the FX JetBot EA was able to collect an astonishing achievement of collecting the gain level of +1,297.55% at the same time having a maximum floating drawdown level of 46.22%. The monthly level of profit for the FX JetBot robot is set at a stunning level of 130.54% and the daily percentage of the compound return through the live trading of the robot is also high – 2.82%. You can acquaint yourself with the mentioned numbers by carefully looking through the screenshot attached below.

As it can be seen from the numbers given and analyzed above the FX JetBot EA shows good durability and is well-made for long-term trading, as it makes on average 4 times more profitable trades than losing once and had almost no fixed drawdowns that would have damaged the upward growing trading curve. Of course, this automated Forex trading system has got a bit high floating drawdown level of 46.22% but as we can see, the system successfully managed to avoid the drawdowns becoming fixed and confidentially grew the account to an astonishing profit level.

Taking into account the gain statistic of FX JetBot EA live trading together with the 4 months’ live trading period and the mentioned drawdown level we can calculate an approximate profit/drawdown ratio for the system. The profit/drawdown ratio for the mentioned official live trading account of the system is almost 3:1. This is a truly impressive result that we have to keep in mind while analyzing all the technical features and parameters of the robot, which we will be conducting further in the review. These results are also pretty impressive taking into consideration that the system has been working live for only 4 months yet.

Type of Trading

The main idea of the FX JetBot EA claimed by the developer as a strongly well-thought-out feature is the special algorithm that is supposed to calculate the best entry point for the trades. This sophisticated algorithm is supposed to accurately predict the best market conditions and currency prices to enter the market by opening the trade in the appropriate direction. According to the developers’ statements, this algorithm alongside other features of the robot is responsible for such a successful trading history and achievements in terms of profit. The developer also points out other following features of the system:

The best currency pairs for the FX JetBot EA are the following 5: AUDUSD, EURJPY, EURGBP, USDCAD, EURUSD;

The average win rate of the system is close to 80%;

The average profit per trade is more than twice as high as the average loss per trade;

The EA almost always works with a fixed lot, without using Martingale;

Easy to use even for complete beginners;

The minimum possible deposit can start from $190;

The FX JetBot robot is not sensitive to spread;

The system can work with any broker and account type;

It also has a built-in loss limitation system;

The FX JetBot EA is compatible with both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms and is NFA compliant.

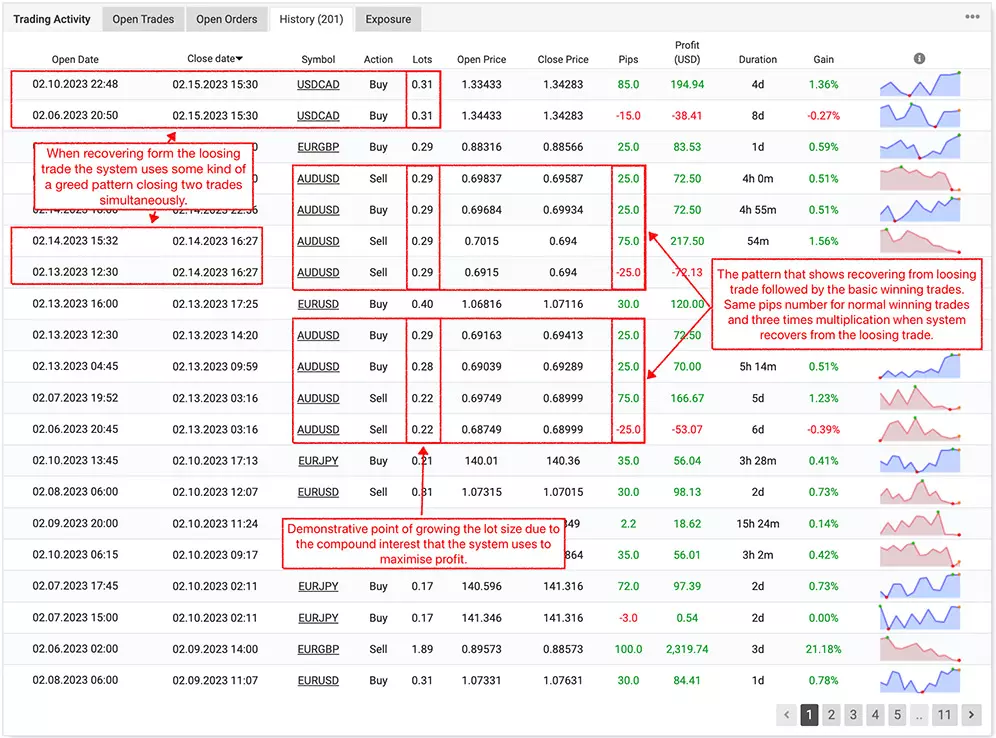

Analyzing the specific live trading charts of the FX JetBot EA we will be paying attention to the pips numbers, lot sizes, and some specific characteristics of the orders. Looking at trading charts in general terms, I can admit that this automated trading system truly does not use the Martingale system for multiplicating profits (as it is claimed by the developer) and also it is not scalping EA, as we can see that there are no short time trades on the graphs.

So, starting with the lot size of the system’s trades we have to mention that the robot is set to use the specific fixed lot size for each currency pair the system is able to trade with. But it does not mean that the lot size doesn’t change from trade to trade. As we can see from the screenshot below, the system obviously uses the compound interest to maximize the profit, so the lot size increases due to the gain growth.

Using some of the examples of the latest trades conducted by the FX JetBot EA on the AUDUSD currency pair, we can admit that to recover from losing trades instead of a lot increment the system increases the number of pips taken in the winning trade. Every recovering trade for the AUDUSD currency pair in the examples is multiplied three times (from 25 pips for a regular trade to 75 pips for recovering trade). I believe that the multiplication level is different for each currency pair the system works with. And I think that the same is true for the lot size. Look at the screenshot above for more details on these matters

Also, while analyzing the examples in the screenshot above we can see that the system usually uses some kind of a grid when it is recovering from a losing trade. It means that the system closes the last losing trade simultaneously with the recovering winning trade which has an increased number of pips.

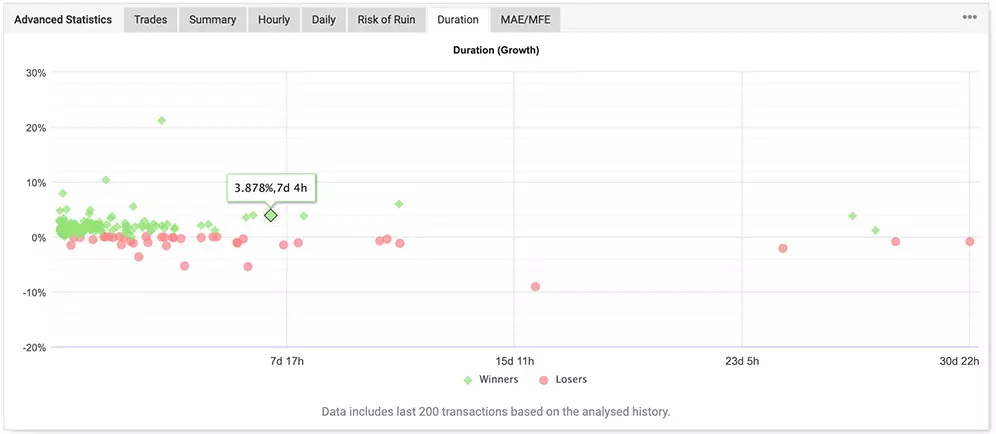

Moving to the next section of our review we fix our attention on the duration of FX JetBot EA trades. As we can see from the screenshot below, in general, the system can keep the trade in the market for a long time up to more than 30 days. But most of the trades of FX JetBot EA are closed in the range of around 20 minutes to 7 days. Also, more than 60% of the trades that are kept open longer than 7 days, eventually turn out to be losing once.

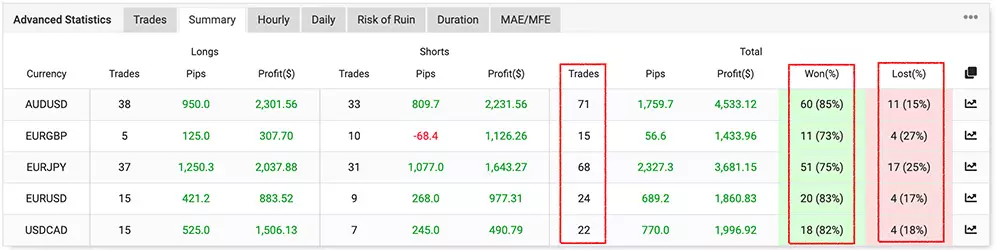

The developer of the FX JetBot robot gives a lot of details on the trades’ win rate of the robot to show that it is successful because of the algorithms that calculate the entry point for the trades. And so far it is truly so – during the trading period of the robot, FX JetBot EA made 200 trades, which on average is 1.6 trades per day.

The ratio between winning and losing trades is truly around 80/20% among all the currency pairs. The most tradable currency pairs for the FX JetBot EA during the 4 months live trading period turned out to be AUDUSD and EURJPY, they make up approximately 70% of all the trades on the account (139 trades out of 200).

Conclusion

FX JetBot EA is a new Forex robot on InsiderFX that is showing great achievements in terms of account growth and durability. This mainly is because the system has got a really powerful algorithm that very effectively finds the Market entry points and manages losses by a built-in loss limitation system.

The performance of the robot is really impressive so far. During only 4 months of trading, it was able to collect a 1,297.55% profit with a 46.22% max level of floating drawdown. The profit/drawdown ratio for the system is close to the impressive number of 3:1.

The specific trading strategy of the FX JetBot EA does not use Martingale or scalping strategies. The system uses the compound interest to maximize its results and to recover from losses it uses pips number increment.

The duration of the opened trades for the FX JetBot EA in general is in the range from around 20 minutes to 7 days, but sometimes a small amount of the trades might be staying open for up to 30 days. Eventually, those trades usually turn up to be losing once.