Minimal Deposit:

Type of Trading:

- Scalping Strategy

Trading Pairs:

- GBPJPY

Leverage:

- 1:200 or Higher

Terminal:

- MT4

Friendly EA Broker:

- XM Broker

STEALTH TRADER FOREX ROBOT

Stealth Trader EA is one of the newest Forex robots produced and represented by the LeapFX company, which shows high results so far. In this review, we’re going to break down the live trading performance of this Forex robot. Read the following review to get additional information about Stealth Trader EA.

Stealth Trader Live Statistics with the Real Money Results

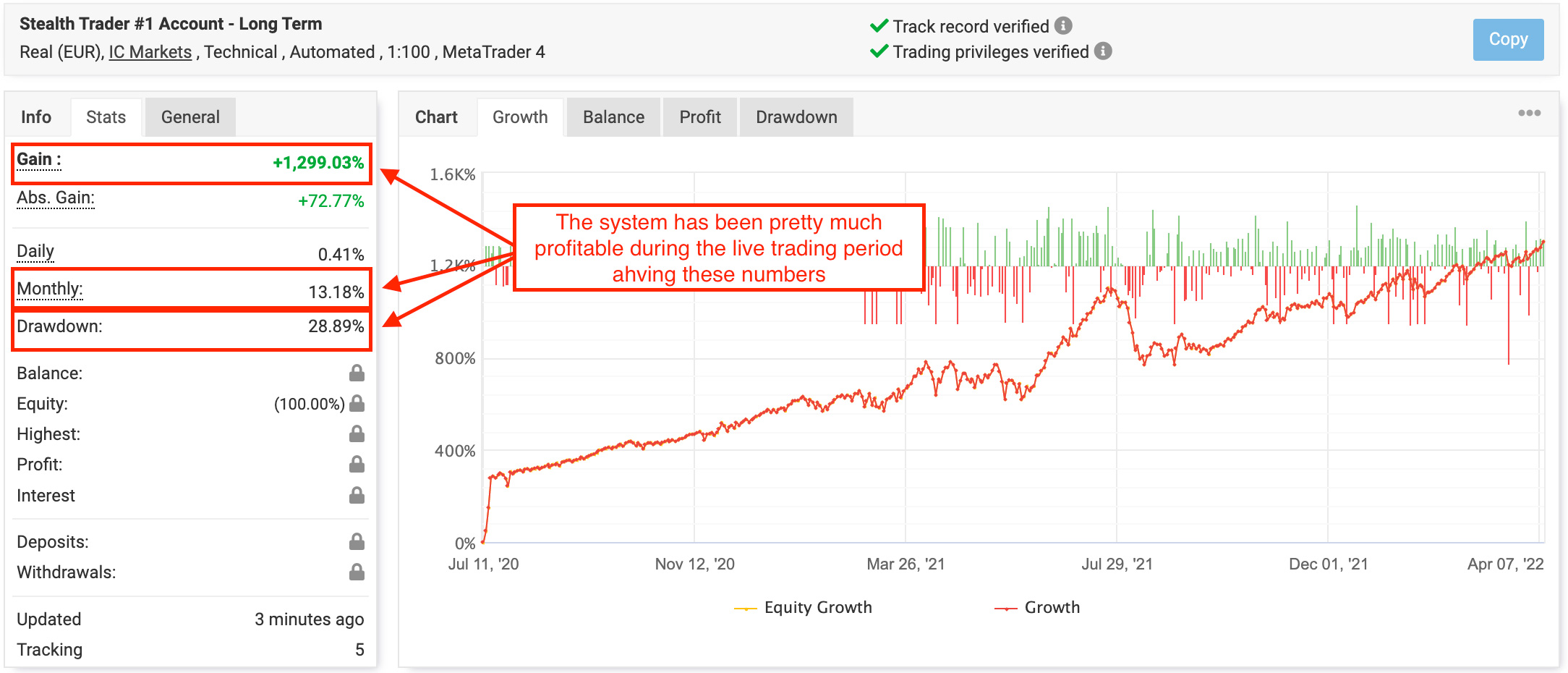

The developer of the Stealth Trader EA provided us with three live trading performance charts by the third-party company Myfxbook. The robot trades only on the GBPJPY currency pair and obviously, all three statistics are live trading on this currency pair. The longest live trading from all the charts has been done on the “Stealth Trader #1 Account – Long Term” account. The Stealth Trader has been trading live on the account since July 11, 2020, which is almost 22 months already. The other two accounts have been live since October 31, 2021, which is only 6 months’ statistics.

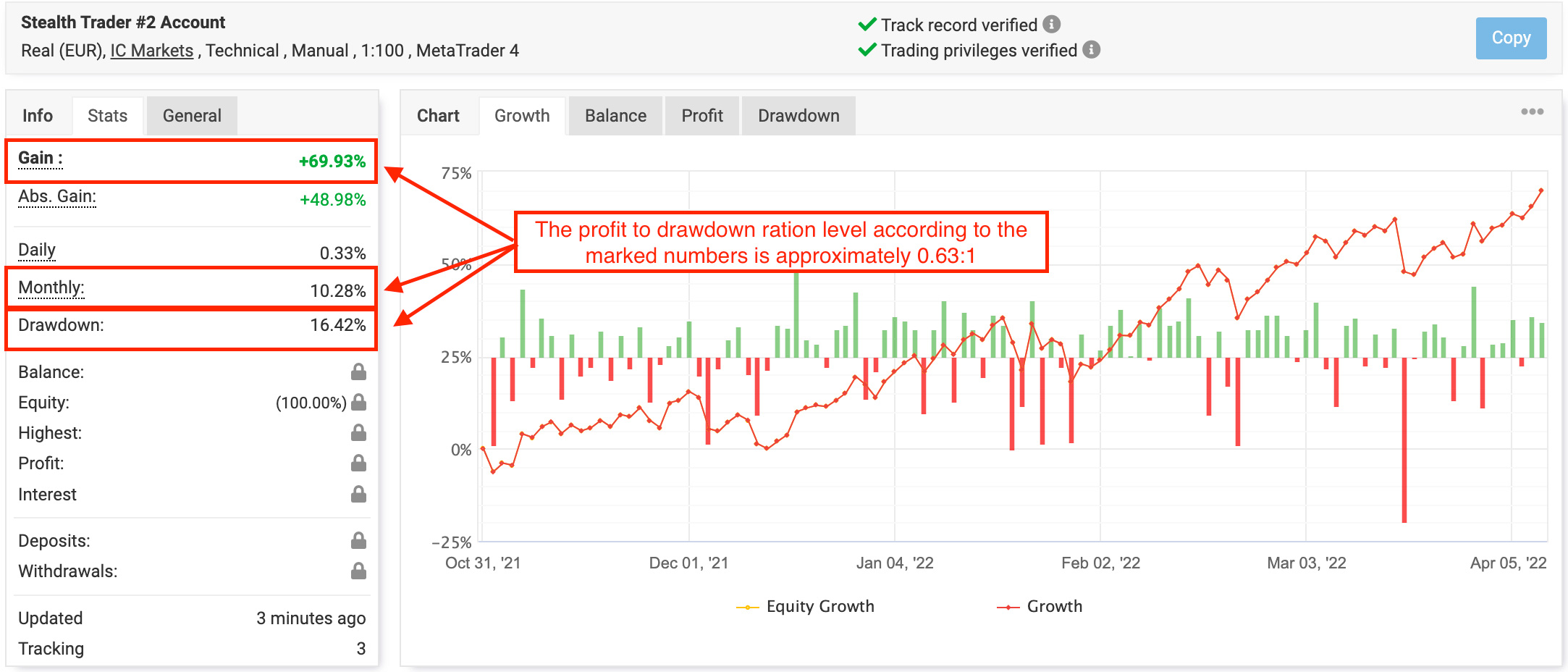

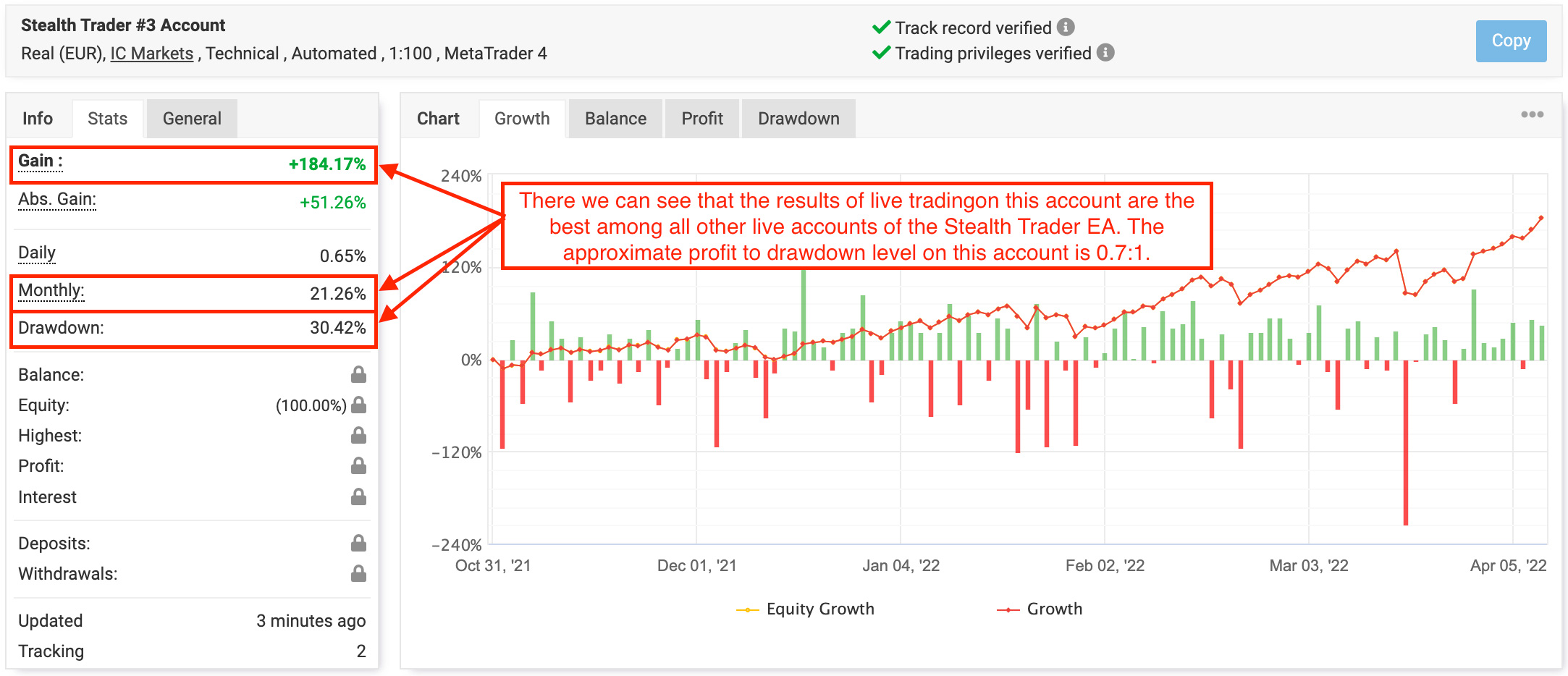

Considering the duration of the live trading accounts statistics, the results look pretty good. The Stealth Trader reached an amount of 1299% of the profit on the “Long Term” account but also much less on two other newly created accounts – only 70% on the “#2 Account” and 184% on the “#3 Account”. The statistics graphs of the Stealth Trader EA look very sharp having many downward movements but still, the main trend is upward, and the profit also confirms this.

There are no backtests made by the MT4 Strategy Tester for the Stealth Trader. But on the official website of the robot, the developer provided some kind of backtests made with the help of the Myfxbook platform. These backtesting results of the system are not that impressive at all. The robot manages to make a little more than 100% of the profit using the data of 3 years of historical quotes. These results really add nothing to the quality of the system, even more, it shows that the Stealth Trader EA might be not that effective in the long-term trading.

All the backtests are made on a 5M timeframe using every tick testing model, which is the most precise method of backtesting based on all available least timeframes. The backtests’ modeling quality is 90% which is okay for this EA because it does not use a scalping strategy.

STEALTH TRADER GBPJPY ROBOT – REAL 1

STEALTH TRADER GBPJPY ROBOT – REAL 2

STEALTH TRADER GBPJPY ROBOT – REAL 3

Profitability & Drawdown of Stealth Trader EA

The longest that Stealth Trader has been working on the live account with real money is 22 months already. As the live trading on the “Stealth Trader #1 Account – Long Term” account began on July 11, 2020. The other two accounts have been trading live only since October 31, 2021, that is 6 months of live performance. The robot has been able to get an outstanding amount of the profit on the “Long Term” account – 1299%. Still, there are no signs of some dangerous practices and technics that might have been done to boost the numbers.

As we can see from the screenshot above, having a high cumulative gain the Stealth Trader EA also has got almost 29% fixed drawdown level. At the same time, the monthly profit level of the Stealth Trader EA is around 13%. Considering those numbers, we can count an approximate ratio between profit and drawdown to see the real risk to reward correlation. Taking into account all the numbers, we can state the fact that the Stealth Trader EA has got a profit to drawdown ratio of 0.45:1 which is almost the same as reversed drawdown to profit ratio of 2:1

Another two of the Stealth Trader accounts, even though they were live only for 6 months, still show even better ratio results. The “#2 Account” reached the gain level of almost 70% having an average monthly profit level of 10%. At the same time, the highest fixed drawdown level on this account has reached the number of 16%. These numbers show us that the approximate profit to drawdown ratio on this Stealth Trader account is 0.63:1 (look at the screenshot below).

The thing that is needed to be cleared here is that the “#2 Account” actually does not work automatically. It is mentioned in the header of the chard screenshot above that the system is Technical but Manual, which means that the trading on the given account is managed manually by the real trader and does not go automatically. This could actually be a sign of some manipulations in the trading logic of the system not only on the given account but also on the customers’ accounts as well, but it is almost impossible to reveal the truth of it.

The third live account of the Stealth Trader EA has also got 6 months of real trading but, in fact, outnumbered the second account having a cumulative gain level of 184% and an average monthly gain of 21%. Considering these numbers as well as the maximum fixed drawdown level of 30% (look at the screenshot below), we can surely count and approximate profit to the drawdown level, which in this case is 0.7:1. This result is the highest among all the trading accounts of the Stealth Trader EA.

The really negative factor of the Stealth Trader EA as well as all other Forex robots produced by LeapFX is that in most cases there is no practical information about the trading strategies of the systems. The developer of the Stealth Trader does not give any clues about the trading algorithms built into the robot. Most of the information on the selling webpage is just commercial materials that aggressively push the customer to purchase Stealth Trader. There is no technical information about what the customer pays for. All the statements, texts, and videos urge a customer that Stealth Trader EA is a cash machine and there is no risk at all.

Stealth Trader Robot Type of Trading

While there are three live accounts, we’ll be focusing on analyzing the one that has the most data to analyze as well as the longest trading statistics. And to begin with, it is needed to be said that there are some problems with the analysis of the Stealth Trader EA statistics. Foremost, it is because the developer of the robot hid a lot of crucial information for the wide trading analysis of the system, such as lot size of trades, the balance, profit, deposit, etc. And so, we will try to get as much information as possible from the data that’s left open.

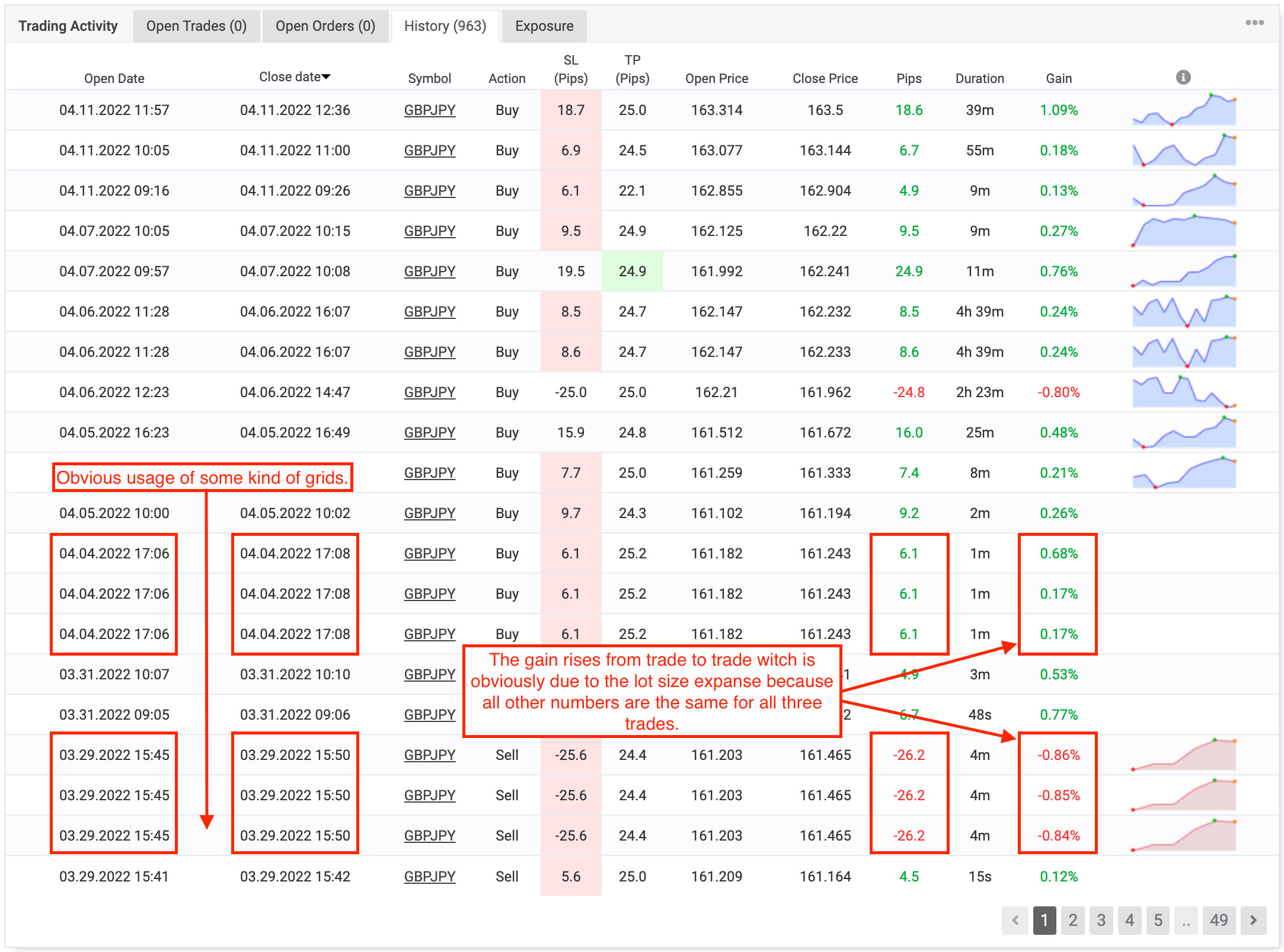

As we can see, even though the developer made a statement that the system does not use Martingale or grid strategy, there are still signs that some kind of grid is used in the trading of the Stealth Trader EA. On the screenshot below, I marked the trade sets that look like grids. And even though we cannot see the exact lot size of the trades, it is still obvious that not all the trades in those columns have the same lot size if we look at the pips and gain columns. The pips taken in those trades are the same for all three trades, but the gain is different. This might look like some kind of modified grid strategy (look at the screenshot below).

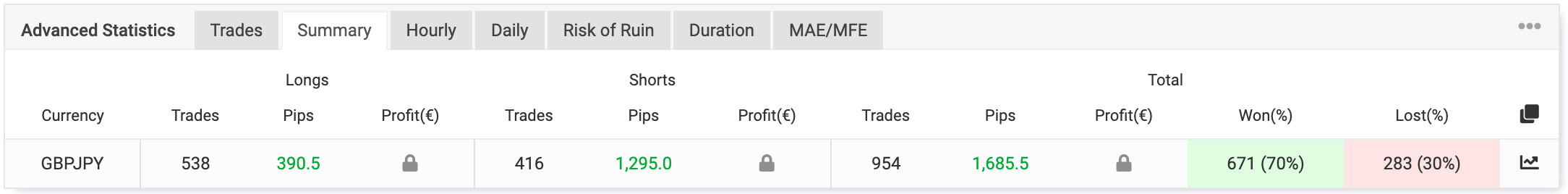

The Stealth Trader EA really nice percentage ratio between won and lost trades – 70/30%. Also, as we can see from the screenshot below, the system trades pretty often. The Stealth Trader EA has done 954 trades during its 22 months trading history. It means that the system on average makes 43 trades per month or 1.4 trades per day, which is what the developer claims about the robot – Stealth Trader EA trades every day.

As it is clearly seen from the following screenshot, the Stealth Trader EA closes most of the trades in a range from 10-15 minutes to 1 hour. Still, some of the orders are closed during a pretty short period, but it does not look like a systematic thing. There is also an interesting fact that there are no losing trades that would have been less than -0.8% of the account equity, which also says a lot about the strategy of the robot.

Conclusion

The Stealth Trader EA is a newly released Forex robot that shows good profit to drawdown ratios and tends to trade in a way to bring high profit with low risks. The system manages to keep all the accounts growing, even though the graphs are not so smooth and strongly upward-looking. There is also some hidden information about this robot that might have changed the way I look at the Stealth Trader EA, but now I can say that the system deserves your attention.