Minimal Deposit:

Type of Trading:

- Grid, Martingale Trading Strategy

Trading Pairs:

- EURUSD

Leverage:

- 1:500 or Higher

Terminal:

- MT4, MT5

Friendly EA Broker:

- XM Broker

FXRISEUP EA

This new Forex robot review is about FXRiseUP EA – Designed to work on the MetaTrader 4 and 5 platforms, this robot uses the SAR (Stop and Reverse) indicator to identify trends and open and close trades accordingly. In this review, we’ll examine the inner workings of the FXRiseUp EA, including its trading strategy, performance metrics, and customization options. By the end of this review, you’ll better understand whether this robot is a good fit for your trading needs.

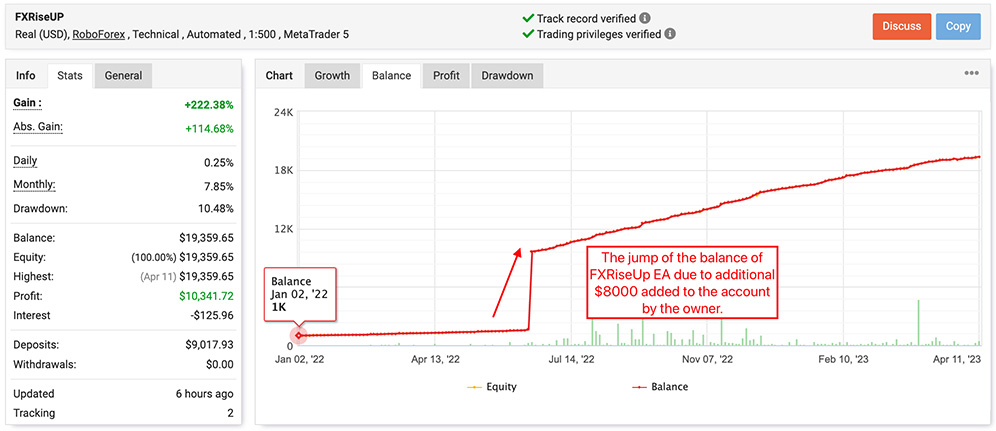

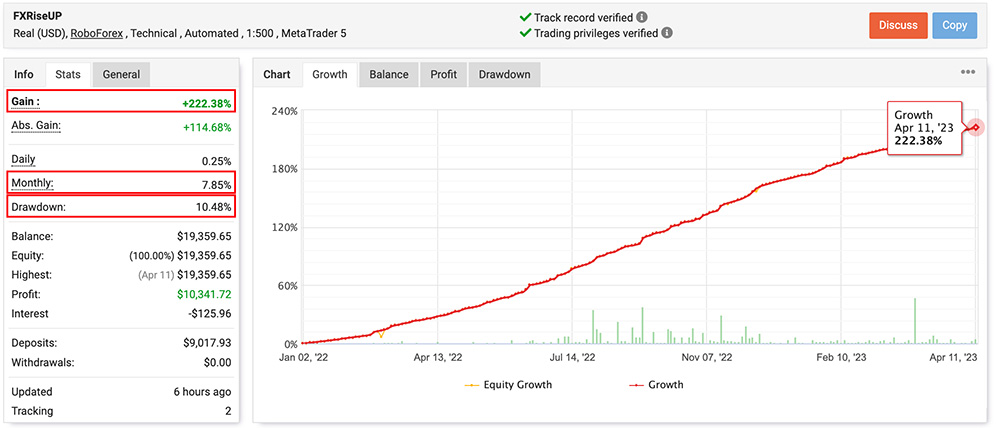

FX RiseUP EA Live Statistics with the Real Money Results

The FXRiseUp EA performance can be analyzed based on its live trading account statistics available on Myfxbook, which started in January 2022 and has been trading for 15 months. During this period, the robot generated an impressive profit of 216.65% starting from an initial deposit of $9,000.

A closer look at the trading graph reveals that the FXRiseUp EA was able to execute trades without significant fixed drawdown or prolonged downward movements. As a result, the live account curves have shown consistent upward trends, with almost straight lines indicating steady growth over time. The FXRiseUp Forex robot’s ability to deliver a profitable trading experience over an extended period is a testament to its trading strategy and risk management system. The EA’s performance showcases a balanced approach to trading that seeks to minimize losses while maximizing profits.

FXRise Up – Real

FXRise Up EA Backtest Statistics

EURUSD Normal

One of the factors contributing to the success of any Forex robot is backtesting, which assesses the system’s potential trading results on historical quotes. The backtest for the FXRiseUp EA was conducted on the 1H timeframe using the every tick testing model, which is widely regarded as the most accurate method of backtesting based on all available least timeframes. This approach involves testing the system’s performance by simulating trades based on each individual tick, thereby providing a comprehensive assessment of its efficacy.

The backtest’s modeling quality is 90%, which is more than adequate for the FXRiseUp EA, given that it does not use a scalping strategy. This level of modeling quality underscores the reliability of the system’s performance and its ability to generate profits for traders. The backtest was conducted over a period of 8 years, from 2015 to 2023, using historical quotes, providing enough data for a proper assessment of the system’s performance. This extended period of testing enabled the system to adapt to various market conditions, providing a more accurate representation of its potential profitability.

Profitability & Drawdown

Live trading of FXRiseUp EA commenced on the 2nd of January 2022, with an initial deposit of $1000 on the trading account. Subsequently, in June 2022, $8000 more was added to the account, thereby increasing the trading capital. FXRiseUp EA is an automated Forex trading system that trades using the EURUSD currency pair on a real live trading account.

Since the beginning of trading, the system has managed to grow the Myfxbook account by 110.90%, which is an impressive result for the Forex robot. The maximum monthly compound level of return achieved by the system stands at 8.05%, while the maximum floating drawdown level is at 17.98%. These results are indicative of the system’s potential to generate substantial profits in the Forex market. Considering the system’s high profitability and impressive performance, it is poised to become one of the most profitable Forex robots in the InsiderFX.

Based on the figures recorded on real live accounts of the FXRiseUp EA, we are able to draw some assumptions about the potential future outcomes of utilizing this particular trading robot. Over the course of 15 months, the cumulative gain of this EA has reached an impressive 216%. In conjunction with this, the maximum fixed drawdown level has been recorded at 18%. These results indicate that the average profit to drawdown ratio level is almost 0.5:1 or 2:1 when flipped the other way around. While there may be trading robots on ForexStore that have achieved even higher levels of success, the results of FXRiseUp EA are nothing to scoff at. It is important to note that these results have been achieved through the usage of real live accounts, as opposed to simulations or backtesting.

With a cumulative gain of 216% and a maximum fixed drawdown of 18%, it is clear that FXRiseUp EA has been able to perform consistently and effectively over a prolonged period of time. These results should be taken as an indication of the EA’s potential for future profitability, although it should be noted that past performance is not always indicative of future results. Overall, while these results are not the highest recorded for a trading robot on ForexStore, they are certainly impressive and indicate that FXRiseUp EA is a viable option for traders looking to maximize their profits while minimizing their risks.

Type of Trading

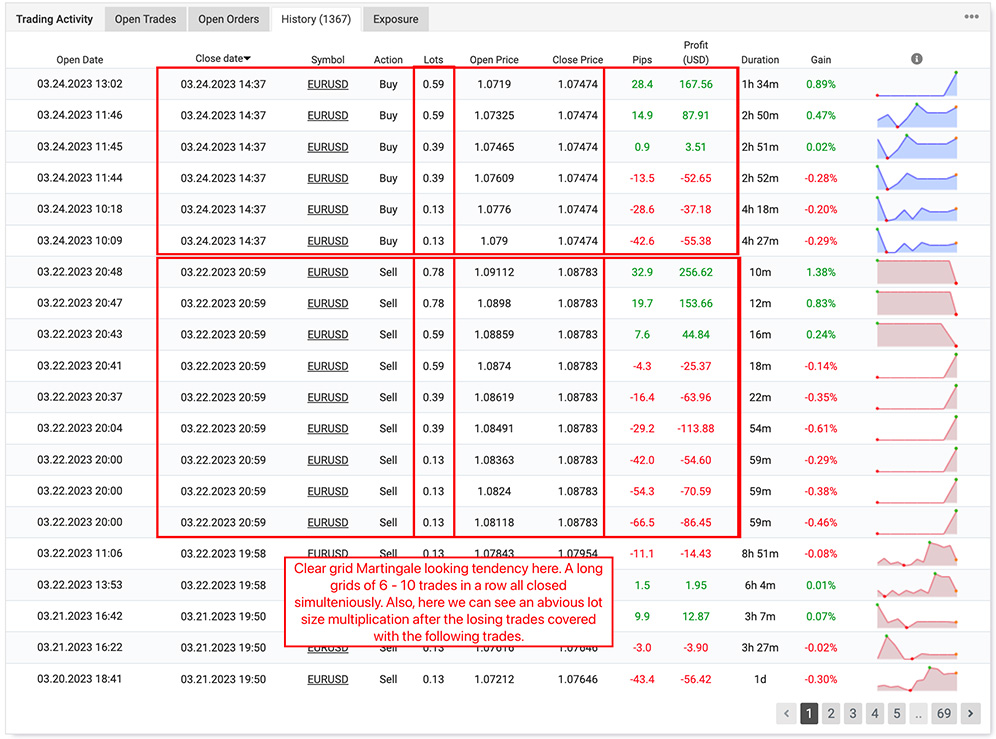

Upon analyzing the live performance graphs of the FXRiseUp EA, it is evident that the system utilizes a grid Martingale trading strategy. This trading approach involves multiplying the lot size for the next trade after a losing trade for the specific currency pair. This process is repeated up to 10 times in the live trading of FXRiseUp EA, with the aim of recovering from the previous losing trades.

Interestingly, the system does not use lot-size multiplication for the grids of winning trades. This indicates that the Martingale pattern is used solely for the recovery process after a losing trade. By refraining from multiplying the lot size for winning trades, the system reduces the potential risk of incurring larger losses in the event of a prolonged losing streak.

Interestingly, the system does not use lot-size multiplication for the grids of winning trades. This indicates that the Martingale pattern is used solely for the recovery process after a losing trade. By refraining from multiplying the lot size for winning trades, the system reduces the potential risk of incurring larger losses in the event of a prolonged losing streak.

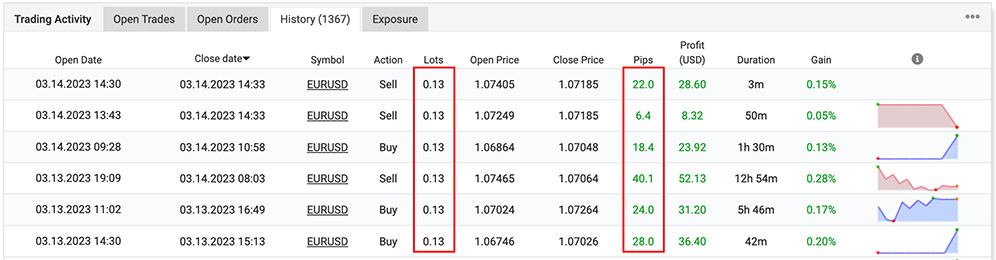

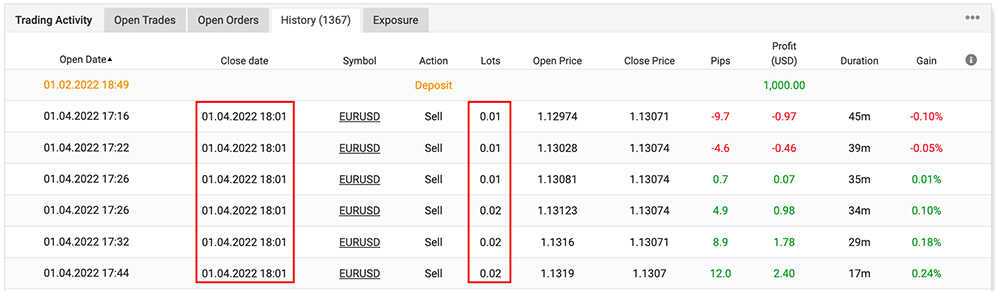

Also, it is evident that the FXRiseUp EA utilizes a compound interest approach in the calculation of its initial lot size. It is clearly seen in the following screenshot. The system’s initial lot size grew from 0.01 at the beginning of the live trading to 0.13 at the time of writing this review. This approach allows for the gradual growth of the lot size, ensuring that the system can handle larger trades as it gains more experience and knowledge of the market.

Since its inception 15 months ago, the FXRiseUp EA has made an impressive 964 trades, a testament to its durability and reliability. This translates to an average of approximately 64 trades per month or more than two trades per day, highlighting the EA’s active trading nature. Also, the system’s performance is also commendable, with a win-loss ratio of 58% to 42%. This means that the FXRiseUp EA makes slightly more winning trades than losing ones, indicating its proficiency in generating profits for traders who utilize it.

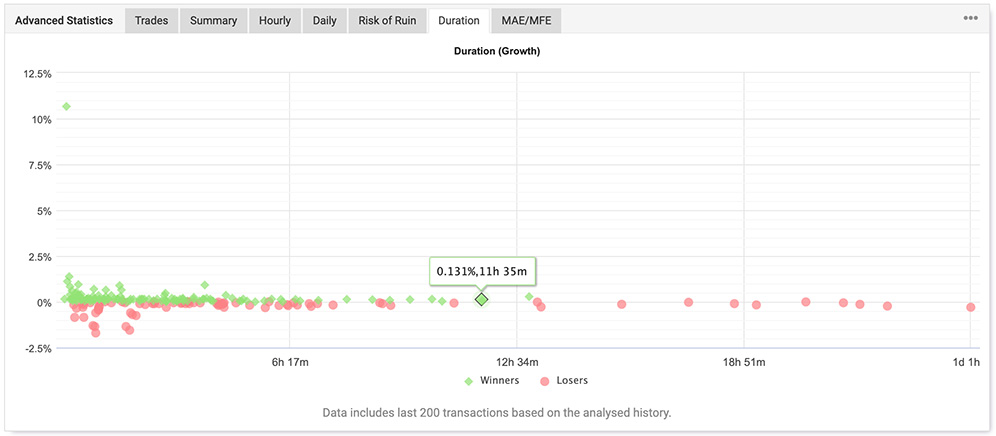

The FXRiseUp EA’s trades typically remain open on the market for a duration ranging from 3 minutes to 1 day, reflecting the system’s agility in adapting to changing market conditions. However, the approximate average duration of trades is from 7-10 minutes to 11 hours, indicating the system’s proficiency in capturing opportunities within short to medium timeframes.

Interestingly, this duration range is where the FXRiseUp EA tends to make the most profitable trades. As demonstrated by the graphs in the following screenshot, most of the trades that remain open in the market for more extended periods eventually become losing ones. This underscores the importance of the FXRiseUp EA’s active trading nature, which enables it to quickly capitalize on market movements and exit positions before they turn against the system. FXRiseUp EA real live trading results taken from Myfxbook

The ability of the FXRiseUp EA to optimize its trade durations according to market conditions enhances its potential to generate profits for traders. By analyzing market trends and acting swiftly, the system maximizes its chances of closing trades at optimal levels, thus minimizing losses and maximizing profits.

Conclusion

In conclusion, the FXRiseUp EA is a Forex robot that has shown impressive results over a period of 15 months on a real live trading account, generating a profit of 216.65% starting from an initial deposit of $9,000. The robot’s performance showcases a balanced approach to trading that minimizes losses while maximizing profits.

Backtesting for the system was conducted on the 1H timeframe using the every tick testing model, and the modeling quality is 90%, underscoring the reliability of the system’s performance. The FXRiseUp EA trades using the EURUSD currency pair on MetaTrader 4 and MetaTrader 5, and utilizes a sophisticated trading logic that buys at bullish pressure zones and sells at bearish pressure zones. Overall, the FXRiseUp EA is a viable option for traders looking to maximize their profits while minimizing their risks.